Compare the proposed plan versus the current plan while displaying rationale of each investment recommendation with summary notes.

Animated buckets measure allocations to low risk, guaranteed and high-risk income sources. Dials indicate product weighting, asset class allocation and guaranteed income target.

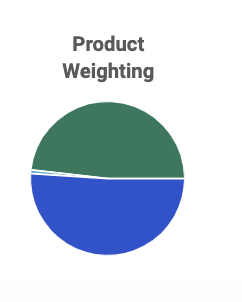

This measures product weighting so as to provide a guideline for identifying concentration information that may be useful for advisors and supervising firms.

This measures product weighting so as to provide a guideline for identifying concentration information that may be useful for advisors and supervising firms.

Note: product concentration limits may vary. See your supervising firm’s rules for details.

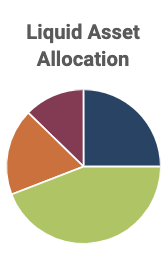

This measures liquid asset weighting which is defined by asset classes NOT allocated to annuities with lifetime guarantee income benefits (GWB). It Is assumed that an income annuity’s accumulation value may fall to zero, though the income benefits will continue based on contractual guarantees.

It can be referenced when allocating liquid assets.

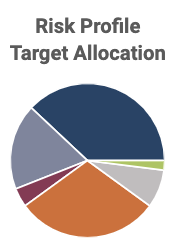

This represents a static model determined by administering a risk tolerance questionnaire. (See Retirement Goals)

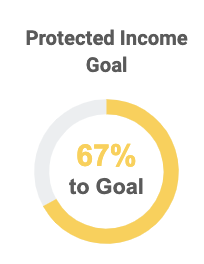

This measures the percentage of Guaranteed Income that you desire to target, relative to the total income need. Adding products with guaranteed income benefits (GWB) will increase the percentage of Baseline/Guaranteed income. Protected income sources include: Pensions, Social Security and Annuities that provide guaranteed income for life (through age 100).

\