Assessing risk

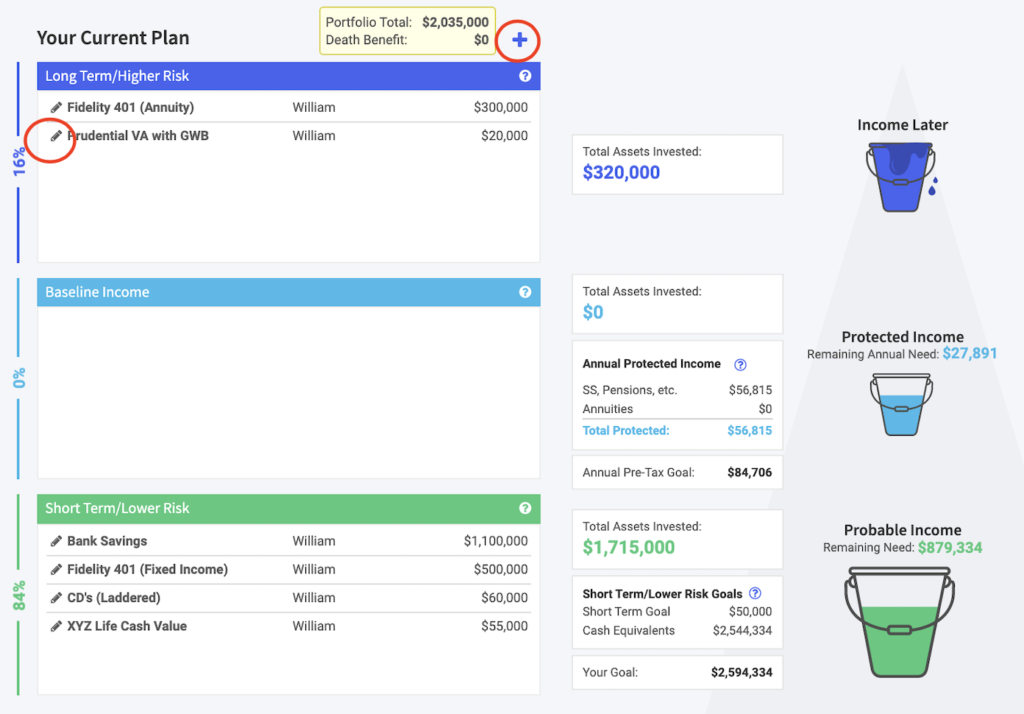

The current plan displays the pyramid of risk and corresponding buckets to illustrate the roll each investment plays in an income plan. The three sections include low risk/short term assets, baseline income and high risk/long term assets. Your client’s retirement goal is summarized at the bottom of each section and current assets contributing to the target are at the top. Buckets illustrate whether values or over weighted, under weighted or right on track with target amounts.

Example: an under weighted bucket in the baseline income section represents the need to increase the allocation to products producing guaranteed income that will accomplish hitting your client’s stated target.

Short-Term/Lower Risk: this section refers to assets (i.e. bonds or cash) that have low to no risk; thus, they are more dependable for use in situations where you need a bridge (i.e. to Social Security), short-term goal or emergencies.

Baseline Income: this section refers to assets that provide guaranteed (predictable) sources of baseline income over a client’s lifetime (i.e. annuity income riders or GWB), or for a specified period of time (i.e. annuity spenddown or period certain).

Long-Term/Higher Risk: this section refers to assets that have higher risk (i.e. equities, alternative investments, variable and index annuities without riders) and provide a long-term inflation hedge. They can be used for future income or as legacy value.

Add, edit, or delete assets

From the current plan page, you can add, edit and delete assets without leaving the page. To edit or delete an asset on the current plan page simply click pencil symbol.

Scrollable

The current plan includes your client’s Short-Term/Lower Risk assets, their Baseline Income assets and their Long-Term/Higher Risk assets all of which have a scrollable feature to allow for detailed asset entry to display an undefined number of assets.