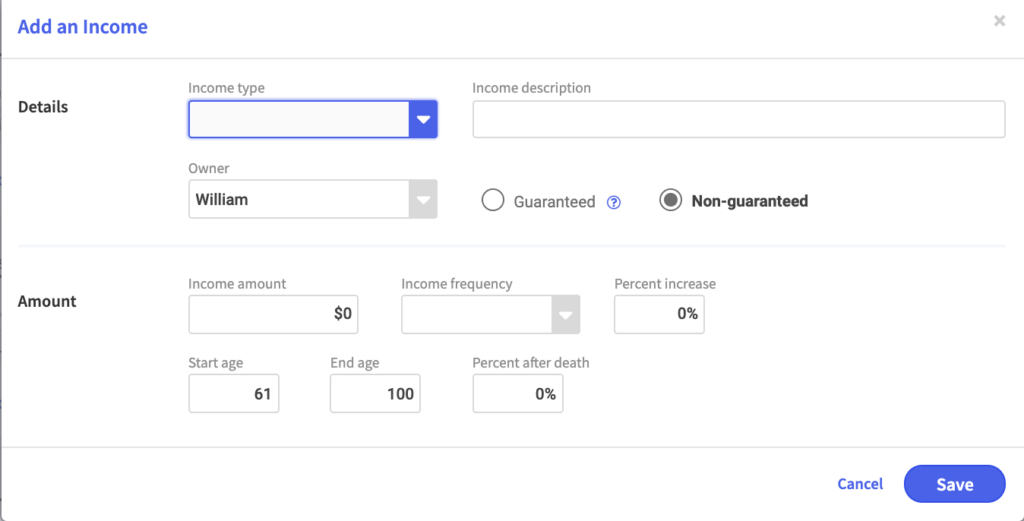

Income

When adding to the incomes, expenses and asset section this can be done two ways either SIMPLE or DETAILED. Choose from a broad range of asset types and attached a Morningstar category to allocate to applicable buckets and accomplish Monte Carlo simulations.

Simple data entry: When using the simple approach, you can aggregate and lump together certain entries under income, expense or assets. For example, rather than breaking down each individual expense you could enter the description of Household Expenses with a total monthly amount.

Detailed data entry: When using the detailed approach, you will enter each individual income, expense or asset and complete the missing fields accordingly.

Income can be added under 3 categories: post retirement salary, pension and other. Examples of other income sources are property rentals and capital gains. Depending on the income type chosen you will be prompted with the appropriate missing fields.

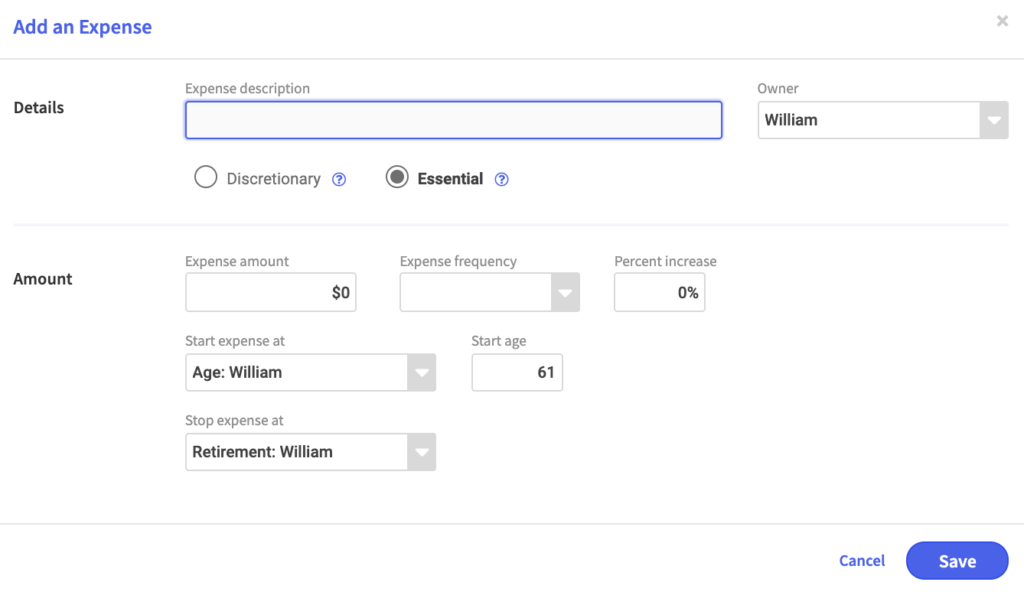

Expenses

When entering an expense, you will want to choose whether it is discretionary or essential, the amount, the frequency, whether it’s likely to increase, what age it starts and what age it ends.

The aggregated expense information represents the income your client needs to stay retired and will show up as a reminder on the Retirement Goals page under the income goal question.

Discretionary: A cost that is not essential for the operation of a home or a business. Essential: Expenses that are essential to meet our needs (ex. Food, shelter).