Basic Information

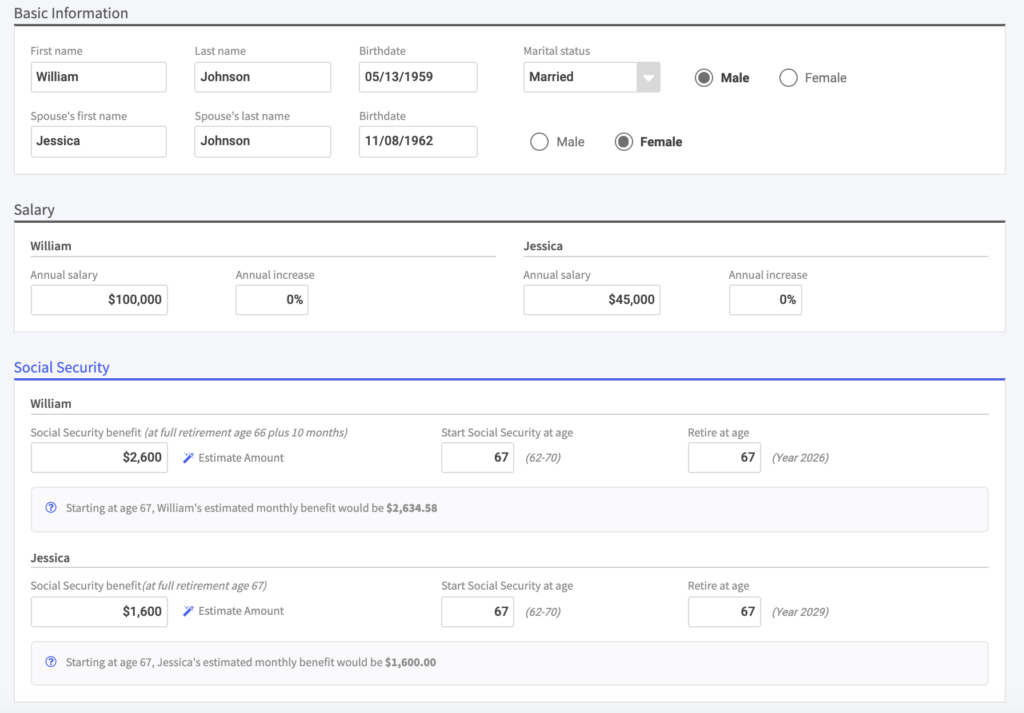

RPS was built to make data entry easier and faster. Simply collect the client’s basic information, salary and social security information to begin your case.

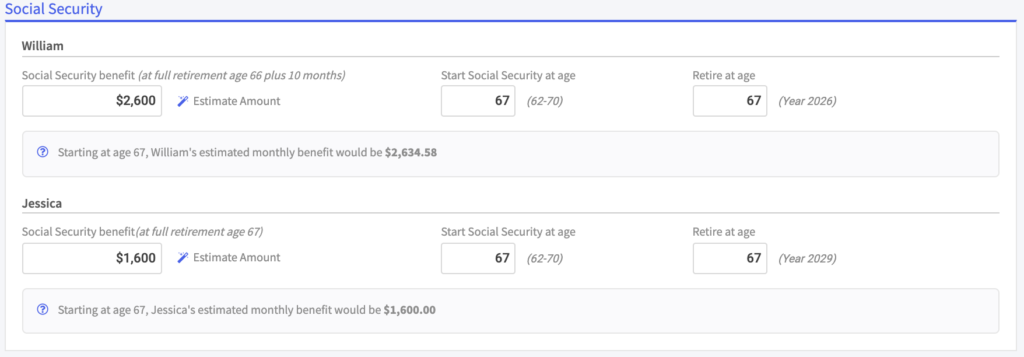

When entering social security, you can run a rough estimate of social security benefits based on salary information or for a more accurate estimate of benefit values the client will need to provide their social security benefit based on full retirement age determined by their date of birth and the age at which they want to start receiving social security.

RPS will then estimate the client’s monthly benefit values if social security is taken prior to the client’s full retirement age. The FRA (full retirement age) amount will grow by the cost of living rate from now until the client’s social security start date.

Please note: Your client will receive a social security statement once every 5 years from age 25 to 60 then annually until they start receiving benefits. The statements are mailed 3 months prior to the client’s birthday however your client can get their benefit statement anytime at www.ssa.gov/myaccount.