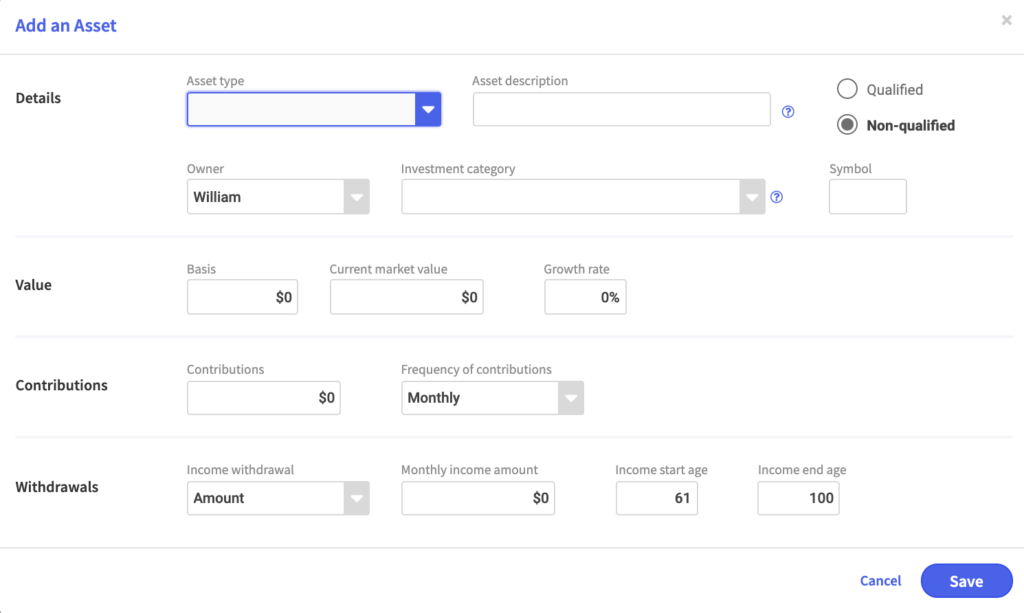

Add an asset

When adding an asset or group of assets from a client statement it can be done two ways SIMPLE or DETAILED.

Simple data entry: When using the simple approach, you can pull asset type information from subtotals under various sections of an investment company statement. Most investment companies like Fidelity or Vanguard break down statement totals by equity, fixed income, mutual funds, annuities and other alternative products.

Detailed data entry: When using the detailed approach, you will enter each individual asset and complete the missing fields accordingly.

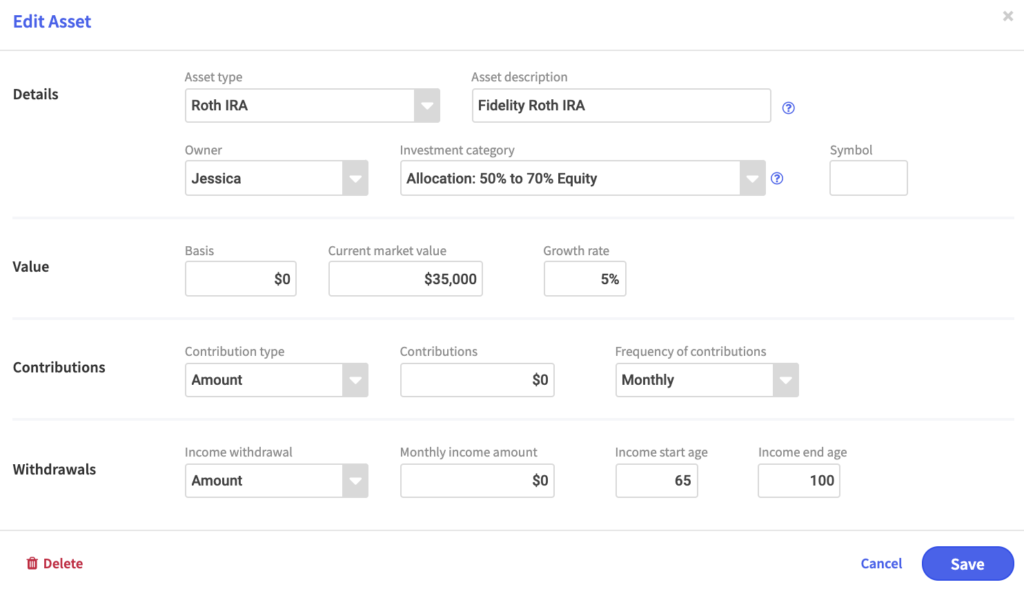

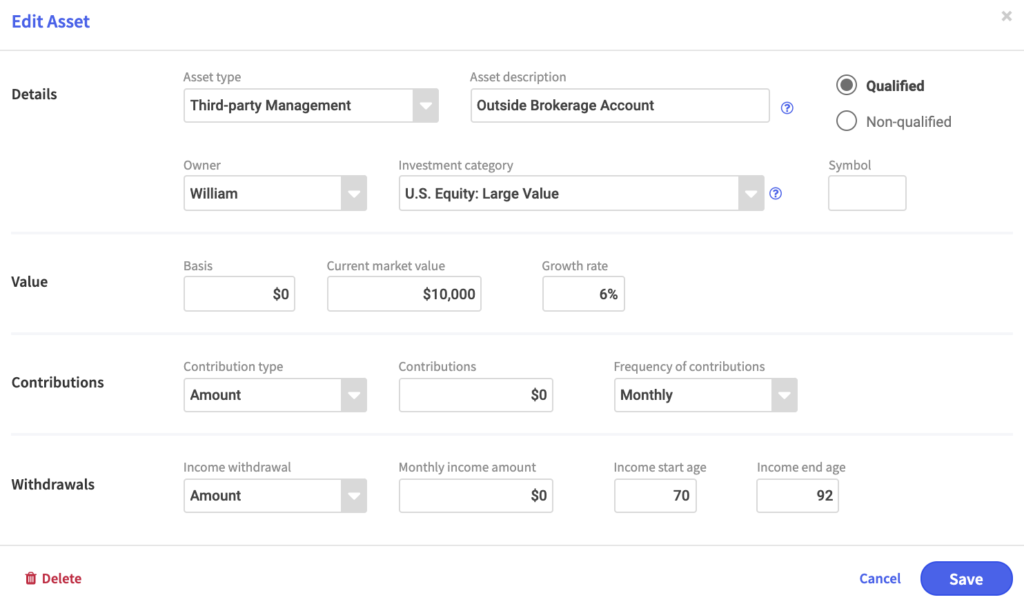

Once you enter the asset type you will need to provide a customized asset description, for example, John’s Fidelity IRA. Once you have chosen the asset type and the asset description you will need to select an appropriate investment category based on the weighting of equity to fixed income. This will apply the applicable variability to the estimated growth rate you provide which is important for Monte Carlo simulations. The investment category you select will also appropriately place liquid assets invested in cash or bonds in the bottom of the risk pyramid under short term/low risk. Equities, variable and indexed annuities without income riders along with alternative investments will be placed at the top of the risk pyramid under long term/high risk.

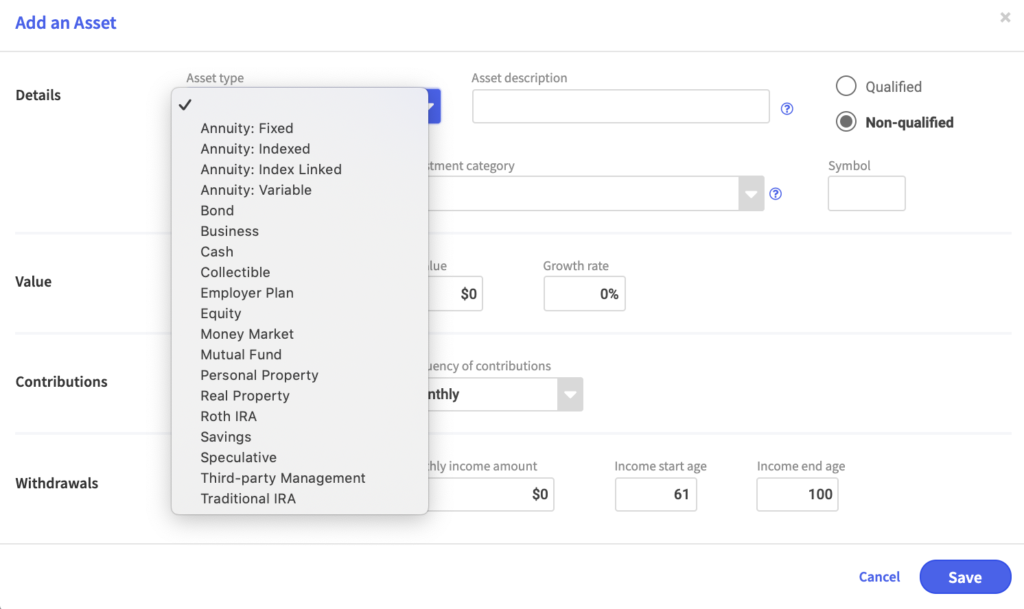

Asset types

RPS has numerous asset types to chose from when entering data.

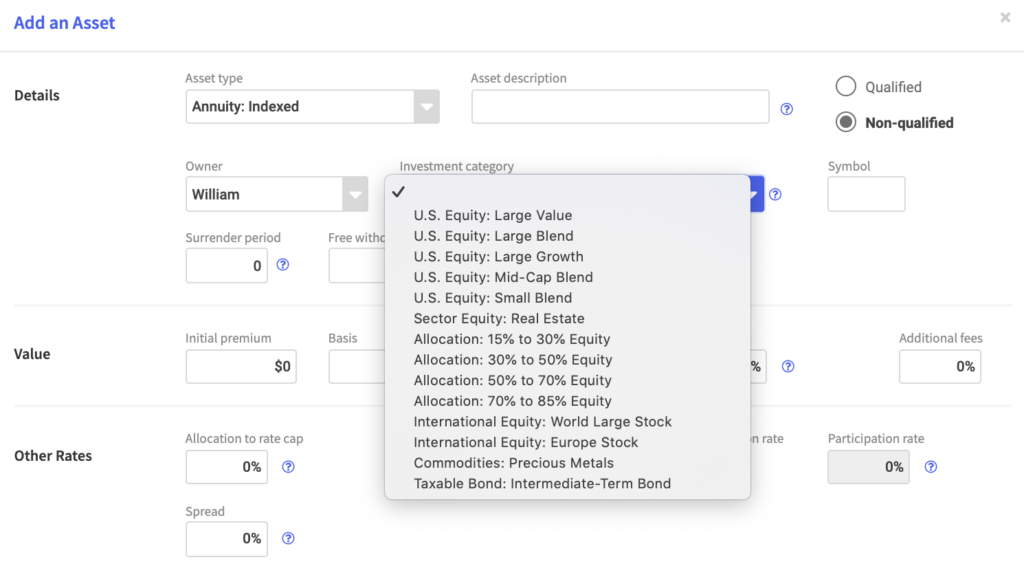

Investment category

The investment category is what drives Monte Carlo simulation in RPS.

While there are various investment category options the most common investment categories used are:

- Allocation: 85% Plus Equity

- Taxable Bond: Multisector Bond

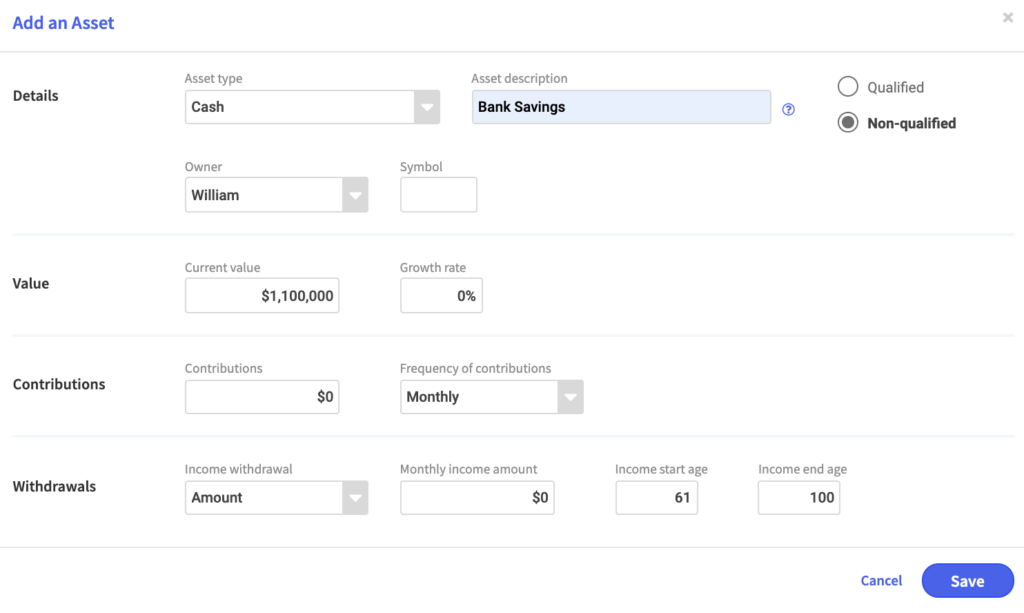

Cash examples

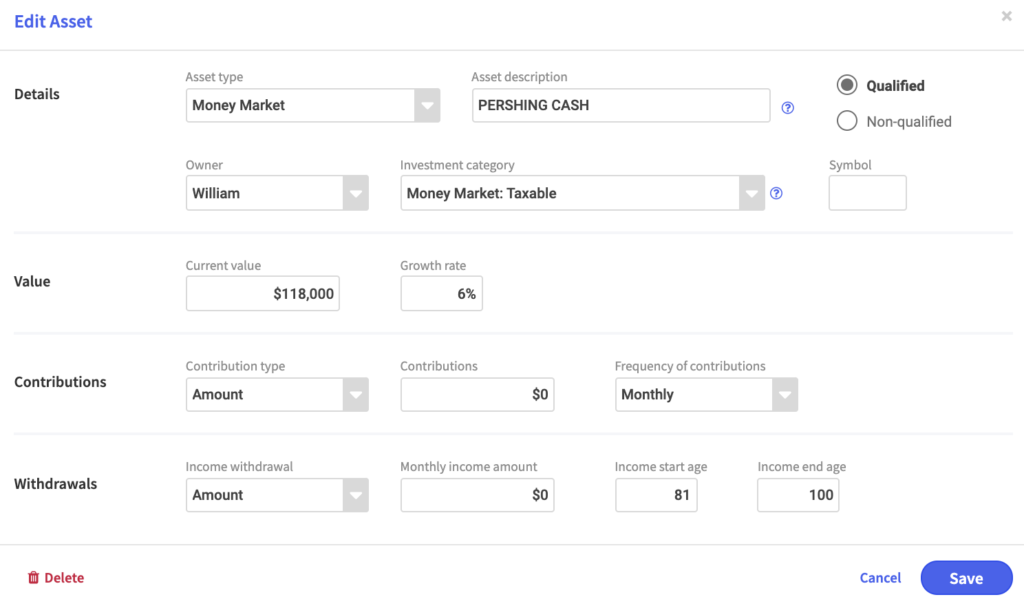

When entering cash as an asset you will want to provide the following details:

- Select cash as the asset type

- Provide a detailed asset description

- Check is the asset is qualified or non-qualified

- Choose the owner

- Provide a symbol if applicable

- Enter the current value and growth rate

- Enter the amount of contributions being made and the frequency of the contributions if applicable

- Enter the monthly income withdrawal amount and whether it is entered as an amount or percentage along with the start and end age if applicable

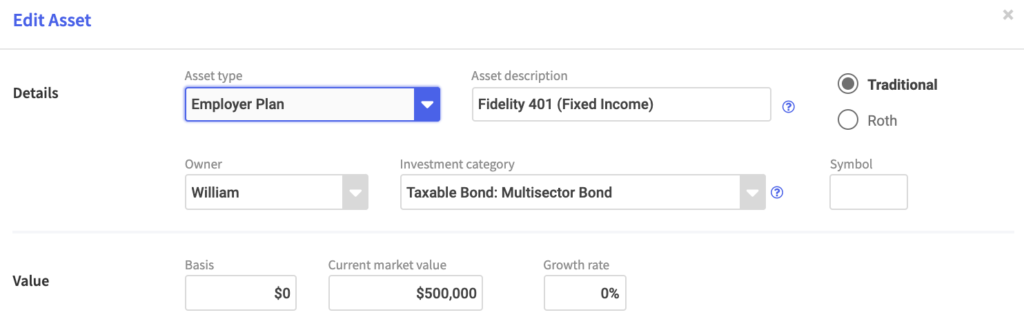

Employer plan example

When entering an employer plan as an asset you will want to provide the following details:

- Select employer plan as the asset type

- Provide a detailed asset description

- Check is the asset is traditional or a Roth

- Choose the owner

- Pick the investment category

- Provide a symbol if applicable

- Enter the basis or current value and growth rate

- Enter the amount of contributions being made and the frequency of the contributions if applicable along with employer contributions

- Enter the monthly income withdrawal amount and whether it is entered as an amount or percentage along with the start and end age if applicable

NOTE: The investment category is what drives Monte Carlo simulation and the flow of assets into the correct buckets. It is important to separate stocks from bonds if/when possible.

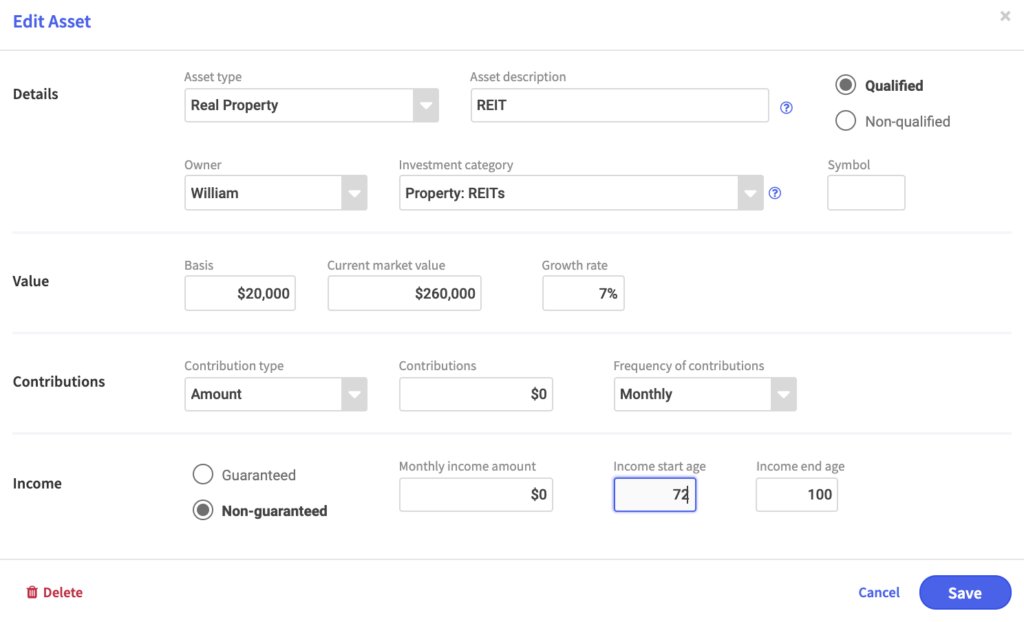

Real property value

When entering a real property as an asset you will want to provide the following details:

- Select real property as the asset type

- Provide a detailed asset description

- Check is the asset is qualified or non-qualified

- Choose the owner

- Pick the investment category

- Provide a symbol if applicable

- Enter the basis or current value and growth rate

- Enter income whether it is guaranteed or non-guaranteed when the amount is along with the start and end age

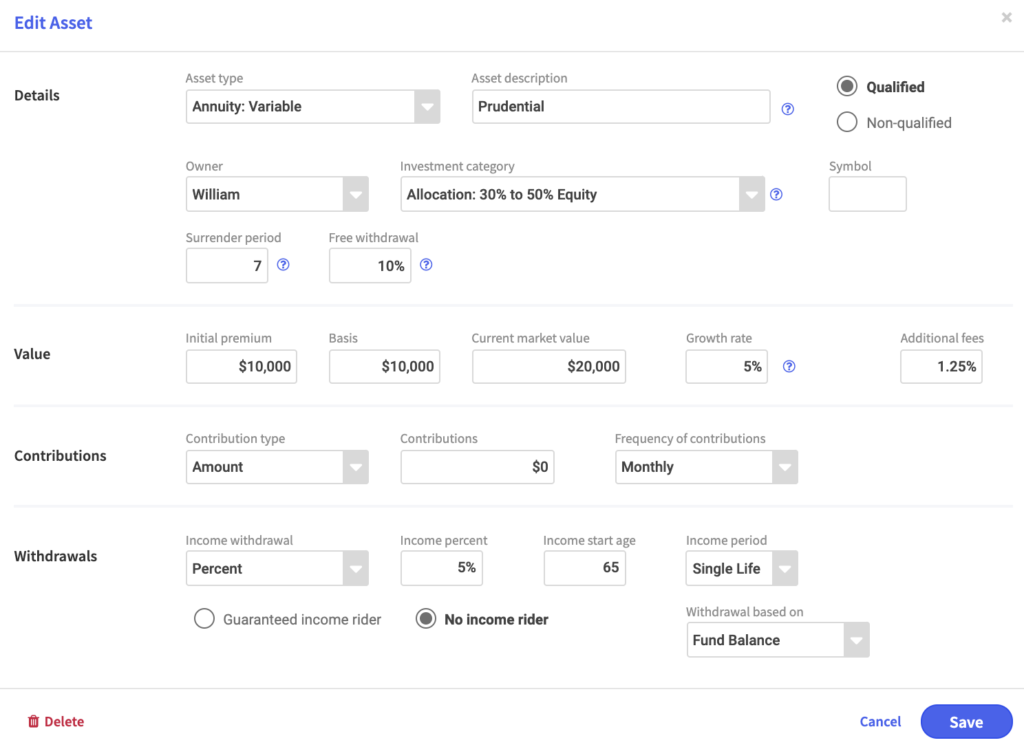

Variable annuity

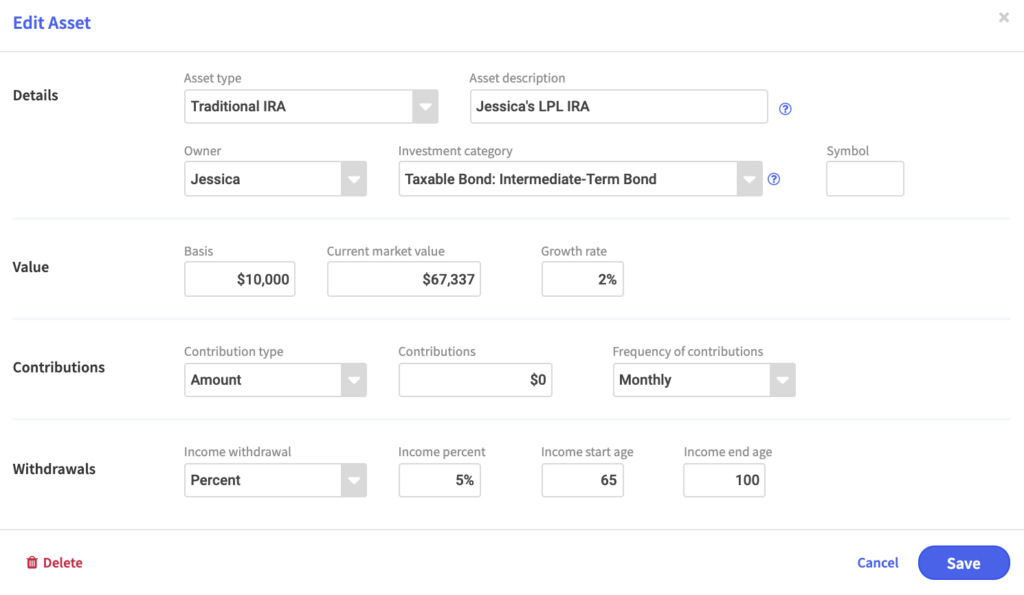

Traditional or Roth IRA

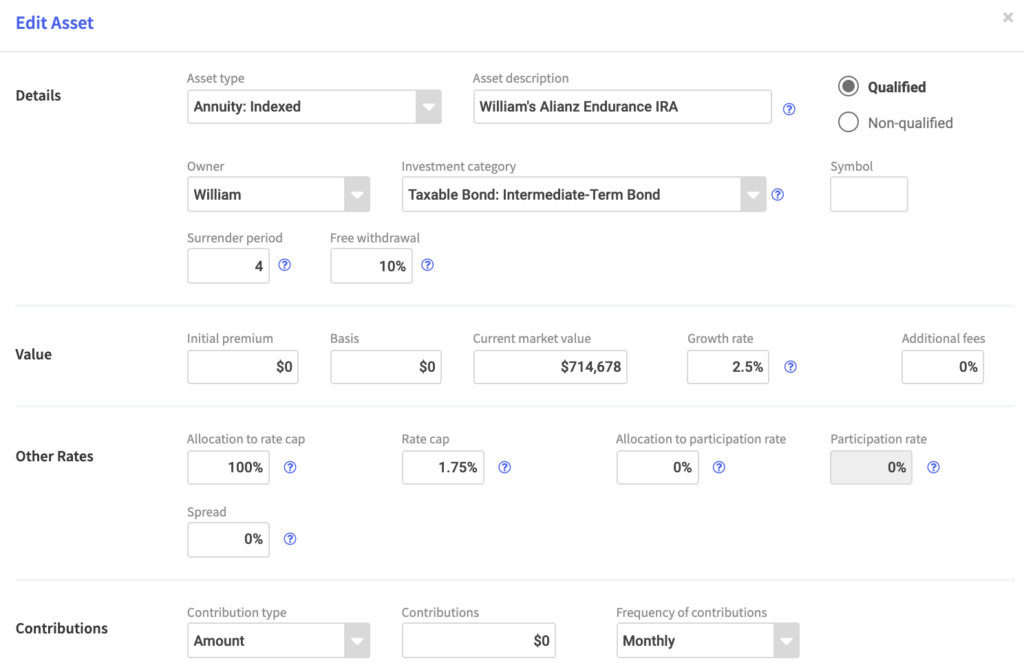

Indexed or fixed annuity

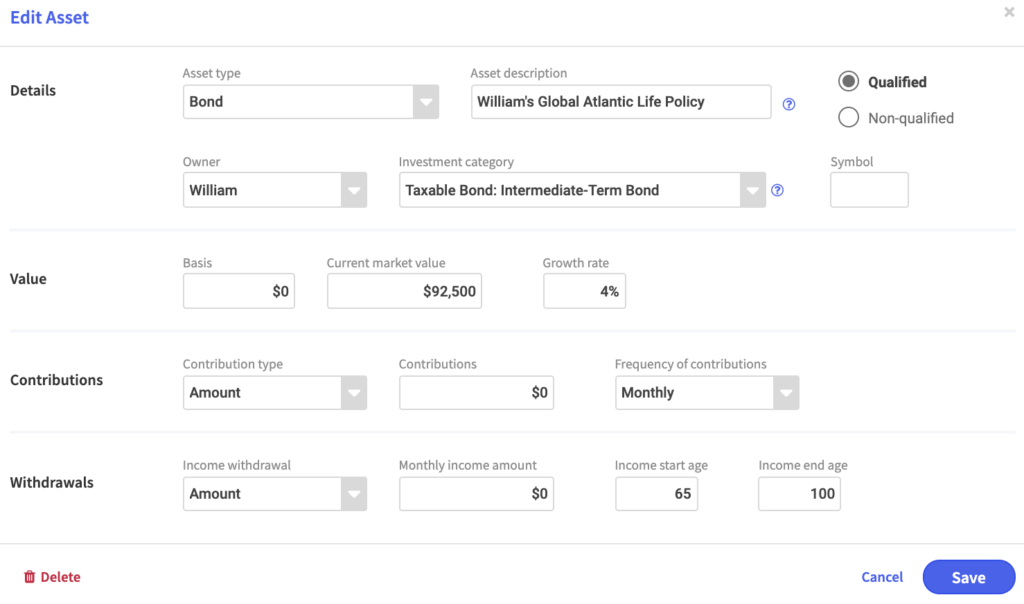

Bond example

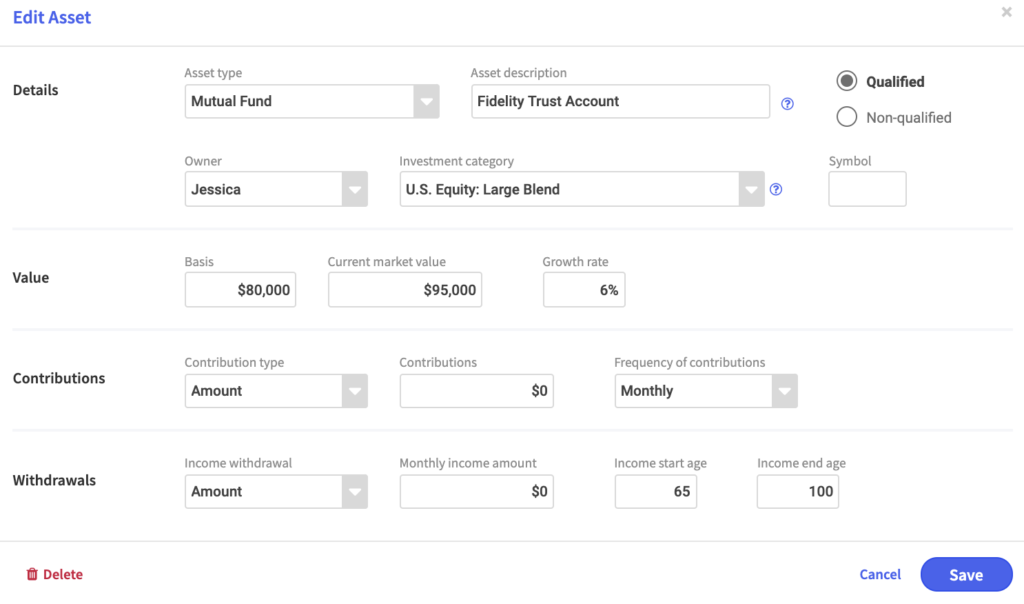

Mutual fund

Equity example

Third party management

Money market example