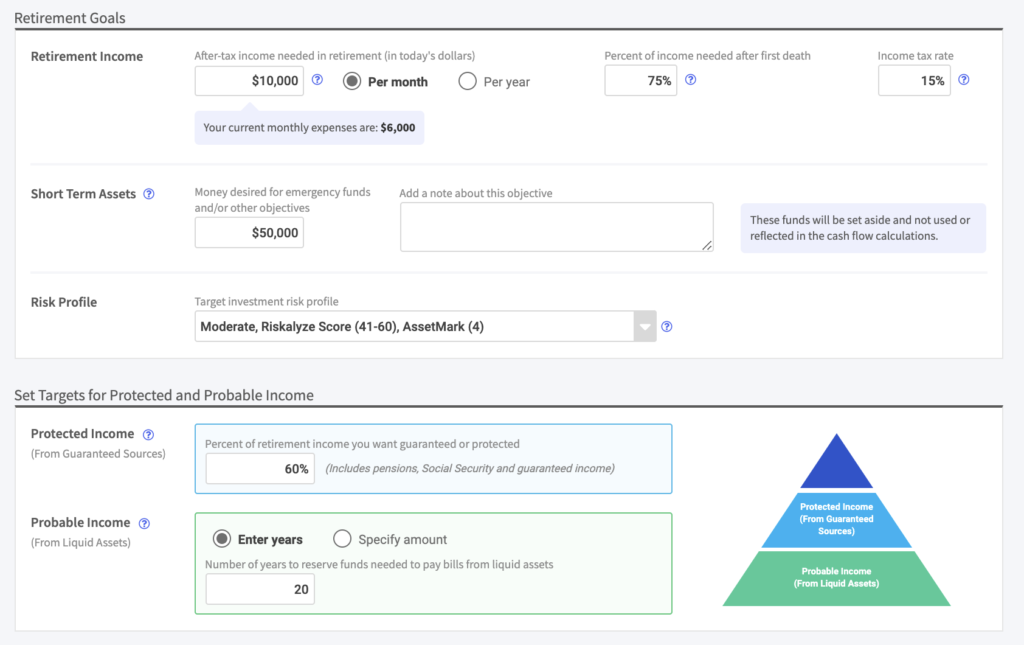

Set desired retirement income goal

Retirement income: is the amount of stated expenses determined under the Incomes, Expenses and Assets section with the addition of what your client ideally wants in total income to go beyond just paying the bills. This number is the total after tax income desired.

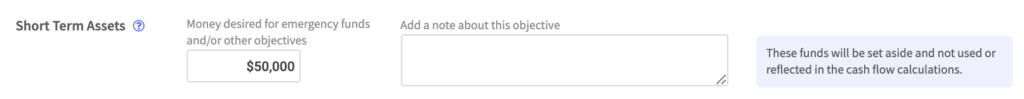

Set Short Term Assets Goal

The short-term asset question is important for identifying your client’s expectations for emergency funds or a specific goal (i.e., buying a second home or new car). You as the advisor are able to get the client excited about retirement by helping them realize a dream.

This value is removed from cash flow as it is assumed that it is spent within the first few years of retirement.

Please note: Don’t forget to take a detailed note outlining the client’s goals and retirement objectives.

Set Risk Profile

This section represents three risk scoring methods based on independent sources determined using the appropriate risk tolerance questionnaire. Each method has been aligned based on the definition and interpretation of risk tolerance. See your broker dealer and/or each firms’ written methodology prior to use.

Please note: RPS does not have an integration with any of the mentioned risk profile companies. RPS has simply aligned risk scoring methods in an effort to provide each advisor control over what they feel best meets their client’s needs.

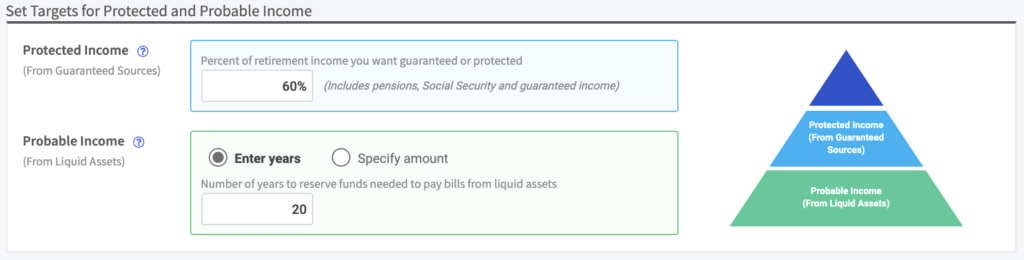

Set targets for protected and probable income

With RPS you can modify the target income for spousal needs, clicking the graph or ledger on page two of the client’s current plan it will illustrate the income need in any year.

Retirement Income = Protected Income Sources + Probable Income Sources

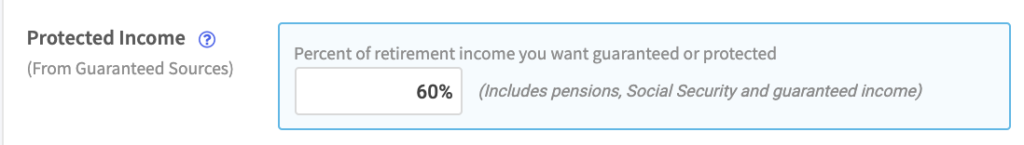

Protected income

The protected income question sets the stage for determining how much of your client’s total income will be derived from guaranteed sources including: social security, pensions, rental property, sale of a business and income annuities. The percent entered here is carried throughout your client’s retirement story as a target chosen by your client. You are in affect putting your client in a position to tell you their comfort level for guaranteed or protected income.

Your clients desired target income is displayed on every page of the current plan, the proposed plan and the summary comparison; it will be your job to determine the types of products to use for hitting your client’s guaranteed income level. Set guaranteed and liquid asset income targets to holistically meet desired income need.

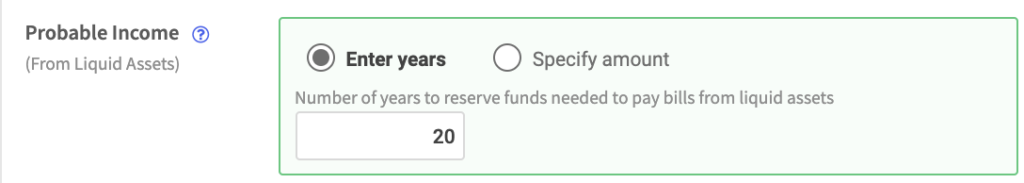

Probable income

The probable income section is EXTREMELY important for the advisor who wants to create an income solution without using an income annuity.

Please Note: It is common for a client to only want a small percentage of their income need covered by guaranteed income products.

RPS will provide the advisor with the flexibility of designing a solution using low risk liquid assets like cash equivalents and fixed income. You can choose the number of years the client wants to pay bills with cash equivalents versus the number of years the client wants to pay bills using fixed income. The system will automatically calculate and track the values to keep the advisor on track during the planning stage as well as during annual reviews.

Please Note: Advisors should use their own planning style to determine the number of years to pay bills with cash versus fixed income or leverage the style of a third-party manager.