Edit owner

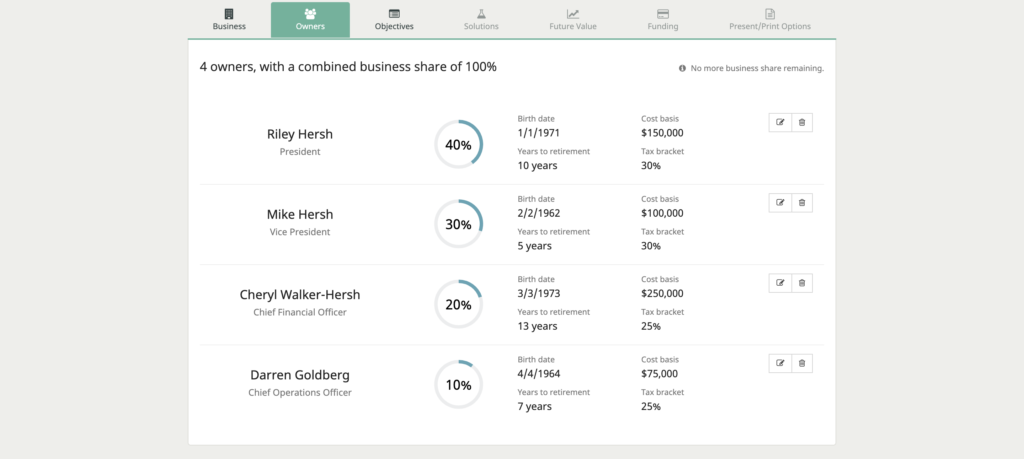

Details about each owner you want to include in the report is shown on this screen. It’s important to note that you do not have to include all owners in the report. Each owner that you do want included or want to make a presentation for must be entered and their respective percentage of ownership shown. That’s done by clicking the Add Owner or Edit icon. A screen is shown for each owner

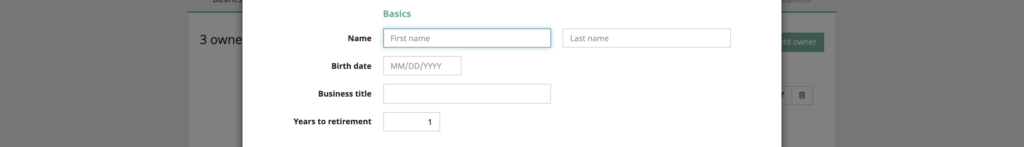

Owners screen basics

Owner’s name, date of birth, and business title must be entered. This information will be shown on the screen and in the printed presentation. The years to retirement is very helpful in determining the years to illustrate before showing the buy-sell being implemented

The financials of the individual basically deals with the ownership percentage for this particular owner and the cost basis, if any. Many times the small business owner put almost no money into the plan, so he has very low-cost basis. Whereas later, owners might very well have to buy their way in and put up a considerable amount of money and so do have a high cost basis. It is very important when it comes time to sell or transfer the ownership to someone else and whether or not capital gains are applicable into what values those taxes are applicable

Tax bracket

The tax bracket is the personal tax bracket of the individual. Typically, we put in the tax rate and for this purpose often the highest marginal rate is used as opposed to just the effective tax rate, since all of these will come on top. Usually, it comes on top of everything else in a given year when any of the taxation for selling the business shares become applicable. When you confirm the owner’s information, it returns you to the Owner Information screen displaying the names, the percentage ownership, the birth date, years to retirement, tax bracket and the cost basis; information that you want readily available in making reference to for the various owners. Enter each owner this way, in the same manner that you want illustrated in the presentation. Any interest that’s leftover will be considered other owners with the remaining percentage applied to them so the full value of the business is always illustrated