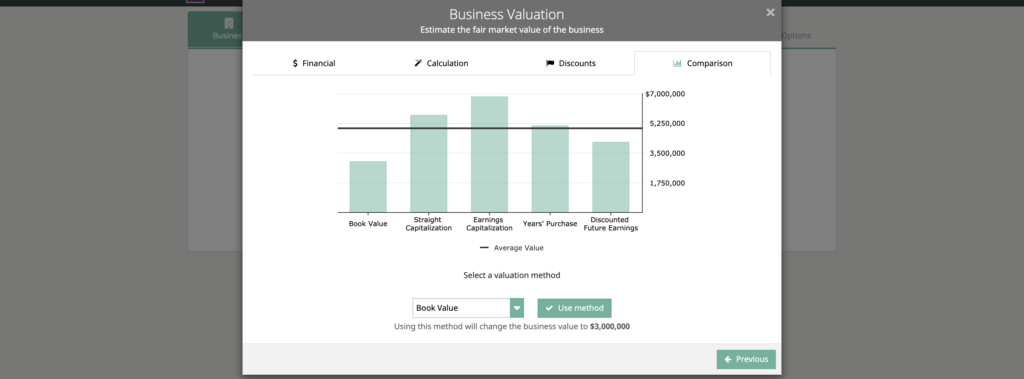

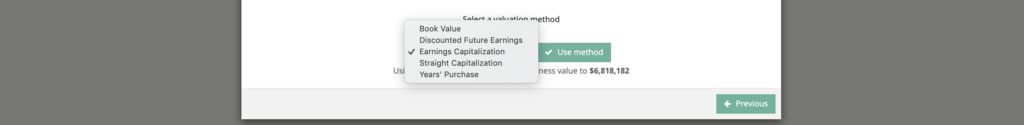

Comparison tab

Straight capitalization

The Straight Capitalization method takes the adjusted average annual earnings (net average annual earnings plus any excess owner salary) and divides it by the Capitalization Rate. This method emphasis the earnings from a risk perspective.

Earnings capitalization

The Earnings Capitalization Method looks at the Adjusted Average Annual Earnings (net average annual earnings plus any excess owner salary) and the estimated earnings on the assets (book value times a fair rate of return). The difference (excess earnings) is capitalized and added back to book value. This method puts emphasis on the basic value represented by book value and values risks as associated with earnings.

Discounted future earnings

The Discounted Future Earnings uses the Adjusted Average Annual earnings and the annual growth

rate to forecast each future year’s earnings. It then discounts each of those years back to today.

The sum of these discounted future earnings is used for this method. This method puts the most

emphasis on the earnings and the investment value of those earnings.

Years’ purchase method

The Year’s Purchase Method looks at the Adjusted Average Annual Earnings (net average annual

earnings plus any excess owner salary) and the estimated earnings on the assets (book value times

a fair rate of return). These excess earnings can be accredited to goodwill; thus, the goodwill

multiplier is multiplied times this excess earnings to determine the value of the goodwill. The

goodwill value is then added to the book value to determine the Years’ Purchase method of

determining value. This method combines the business’s assets with its relationship values.

Average value

The average of all of these methods is a good way to compare the various methods. But the IRS says that averages are not a valid business valuation method. The IRS insists that a fair market value must consider the particular business and not a collection of businesses. Other businesses in the same type of business, the same markets, the same size and type of comparable businesses should be the method applied to this business.

Each business is a combination of one or more methods that works best for it. The IRS says for the value to be

accepted as being fair, it must consider those unique factors of that business and not a collection

of all businesses.

An average is not allowed; you must determine and say why this business is best measured by this method. Only a full appraisal can determine an acceptable value, but the business estimates provided with these methods can serve as a preliminary value for planning.