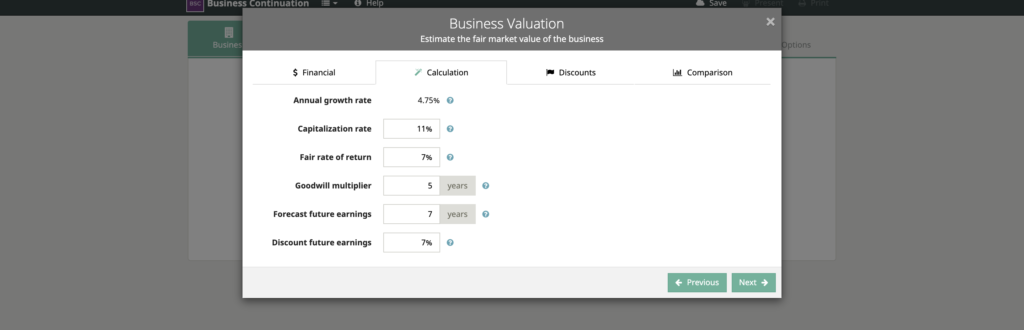

Annual growth rate

The annual growth rate represents the average annual earnings of the business as a percentage of

the revenues, it’s used to reflect the growth rate for the immediate future.

Capitalization rate

Capitalization Rate reflects the risk of the business. A well-established business does not have a lot of risk other than the normal business risks. Typically, its Capitalization Rate is between 12% and 15%. Most, but not all businesses, have some extra risks such as being a new business, has new management, a lack of prior success so the Capitalization Rate is usually a higher—15%-20%. A business that has fewer of those qualities may be 20% and 25%. A new business, just started with an owner who really is not experienced in this business, may have a 25%-30% Capitalization Rate reflecting a higher risk to the business until it becomes established

Fair rate of return

The Fair Rate of Return for a business is if all the assets (the book value) were invested today at rates typically expected, what rate would that be? In other words, if all the assets were liquidated and you just went on the market and invested proceeds, what rate would you expect to receive? That’s the fair rate of return. Usually, that’s less than the average annual growth rate.

(If the owner doesn’t expect the growth of the business to be better than what the assets could be invested, why would he or she invest in the business?)

Goodwill multiplier

The Goodwill Multiplier is basically all of the goodwill, the reputation of the business, and the established clients. These valued relationships with the public would continue for some period. A well-established business might even, if the management left, continue for 4, 5, or 6 years just from the effects of these relationships. That’s the Goodwill Multiplier.

Forecasting future earnings

Forecasting future earnings, this is based on the predictability using past performance. Future earnings are discounted for a Fair Rate of Return investments with similar risks. Usually, this is equal to or greater than the years for goodwill. What’s a reasonable forecast for the business with good management? How long should it be expected to last into the future without major changes or recapitalization? Typically, this exceeds just the goodwill factor.

Discount future earnings

Discount Future Earnings. If earnings are projected into the future, the future value should be discounted back to today’s value. Again this is similar to the Fair Rate of Return. The rate should reflect the rate expected for comparable investment opportunities. In other words, if investing in other businesses with similar risk, what rate would be reasonable? That’s the rate that should be used for the discount. Often it is equal to the rate that we’re assuming for the growth of the business, maybe even higher.