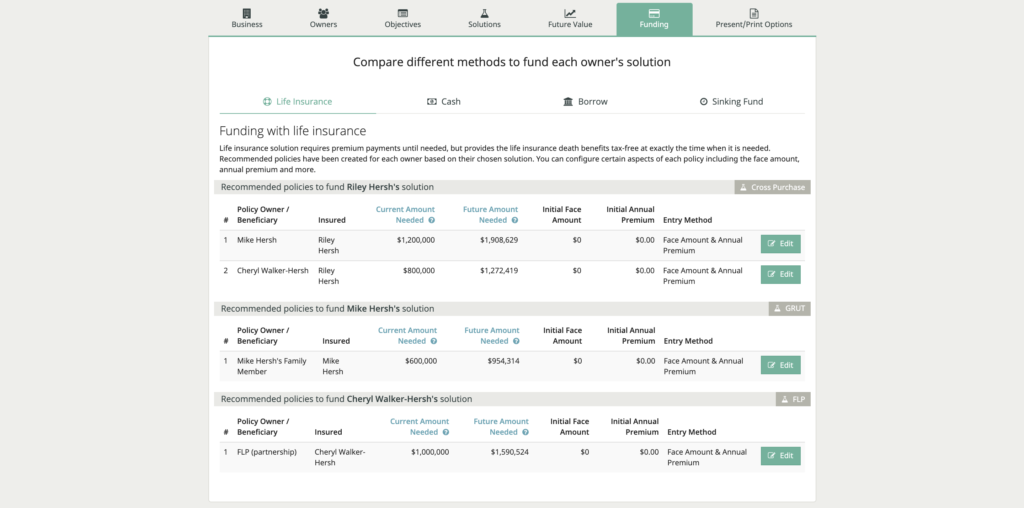

Funding screen

The funding tab at the top compares the various methods for funding Business Continuation.

The input screen shows the basic three generic funding methods: cash, borrow, sinking fund (or savings account). Insurance is an alternative to these three. The comparison graphs on these input screens are applicable to all of the solutions; however, the insurance is specific to the desired solution being illustrated for each owner. The presentations—screen and print—compare the four specific methods being illustrated for each owner’s specific solution illustrated.

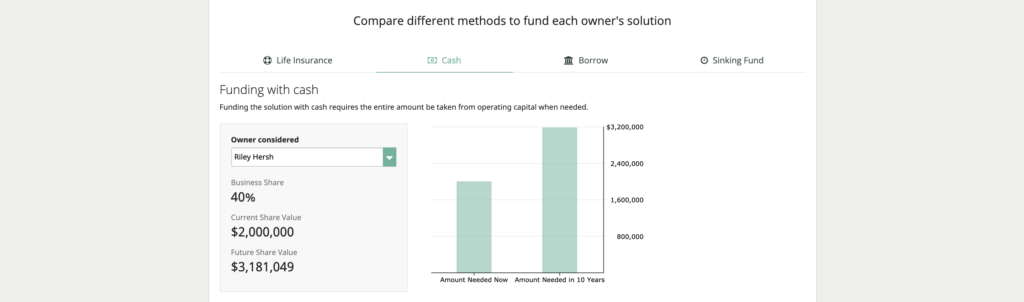

Cash

Cash is nothing more than when the time comes that you need to buy out an owner’s share, you use cash out of the business. The cost is exactly the value of the business interest at that time. It simply depletes the cash, liquid resources of the business, but no payment takes place until the actual sale.

On the cash tab, all the owners considered are in the drop down on the left and you can look at each one independently. It also shows what share of the business they own, the current share value and the future share value. Thus, you see exactly what it would take for the cash option. The cash amount is the amount needed now, which is the current value, and the amount needed in X years. (The number of years entered to show future value of business.) Hovering the mouse over either one of the bars in the bar graphs will show the value.

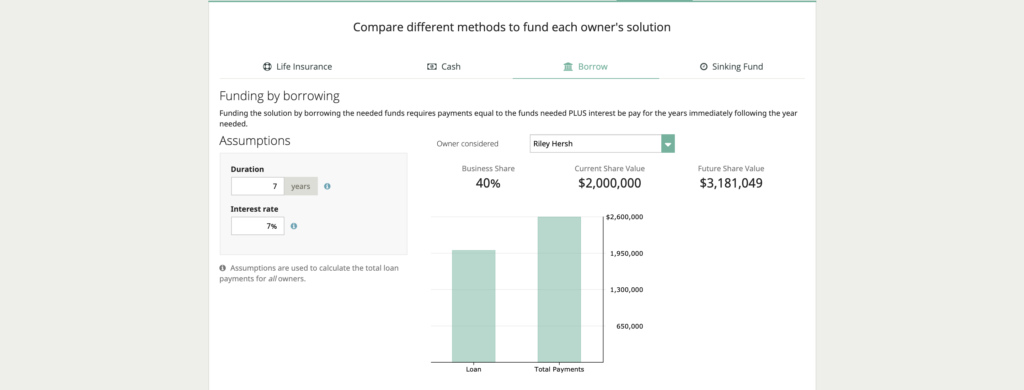

Borrow

You could borrow the money if the business didn’t have the cash. To borrow the money, you would have to borrow the full amount needed. The business would then pay interest, typically to a bank, until that loan is paid off. The cost does not start until the sale, but it continues until the loan is repaid. The cost is increased by the interest paid on the loan.

You can enter the duration of the loan and what the projected interest rate for the loan will be. Again, you can look for each owner’s cost comparison. It shows the loan and then the total payments. Clicking on the loan you’ll see the amount and then the total payments of paying that amount off.

Sinking fund

Another alternative is a sinking fund. That is, to set aside funds specifically for this purpose and hope that you can accumulate the amount needed by the time the funds are needed. The sinking fund typically starts now, but since you don’t know exactly when it’s needed, you may fund too little, or too much. If the funds are not sufficient when needed, one of the other methods will have to be used for the remainder needed. If funds are more than what is needed, then working capital was removed from the business unnecessarily.

You can enter an interest rate along with the tax bracket and it basically shows you how much you would have to set aside each year in order to fund the desired amount for different periods of time. Again, we don’t know when someone will die although we could project when they might retire. Use the sinking fund for that amount. As you see, the longer the funding period, the less you have to save each year. But, if you need it before that time, you’d have to supplement the sinking fund with either cash or borrowing.

Insurance

All three of the above options (cash, borrow, sinking fund) have shortfalls and sometimes combinations of two must be used. An alternative to all of these would be life insurance. Life insurance, especially for death of an owner, could provide exactly the amount needed at exactly the time it’s needed, the death of the owner. Funding (premium payments) starts now and continues until the death of the owner; however, these premiums have the least effect on working capital than any of the three other methods.