How life insurance is determined

A cross purchase solution requires the most policies. In a cross purchase, each owner has to buy a portion of the deceased owner’s interest. Thus, you’d have to have one policy less than the number of owners just to fund one owner’s death. One advantage of Business Continuation is that it calculates the amount of life insurance needed in each situation. For example, in a cross purchase, if we had five owners, one owner owning fifty percent, one with twenty percent and three with ten percent each, making up the 100 percent of the business distributed among these five shareholders.

Funding can be based on the current value of the business or on the projected future value of the business. Of course, it’s preferable to fund the future value of the business. To help with this both the current and future values are shown and the amount needed. Again, one advantage of Business Continuation is that, based on the solution that the owner desires, the policies to fund that solution are automatically calculated and shows who the policy owner-beneficiary is, who the insured should be and what the amount should be.

Some owners may have specific wishes as to the business ownership after their death. However, most owners desire that if one owner dies the surviving owners will end up with the same proportionate ownership as they had among themselves before the owner’s death.

For example, suppose one owner that owned fifty percent dies. The other four, one shareholder owning twenty percent and the other three owning ten percent, want to buy his stock in such a manner that each of them will have the same ownership relationship to one another. The program would automatically calculate and show you the right amount for this situation. (One would purchase 20/50 or 40% of the deceased owner’s 50% interest. Each of the other three would purchase 10/50 or 20% of the deceased owner’s interest. After the purchases, one would own 40% and each of the other three would own 20%.) With these amounts, the ownership after applying the cross-purchase agreement and exercising interest, each surviving owner would have the same ownership relationship to each other as they had prior to the deceased owner’s death. Of course, the difference would be that now the surviving owners own 100 percent of the business.

These calculations can be rather tedious. Business Continuation allows you to enter up to 9 owners and then, even if all of them chose cross purchase, will illustrate exactly how all 72 policies being used should be purchased. The calculations needed to make sure everyone has the right amount in the right policies is quite involved. Business Continuation makes that very easy.

Entering policies to be used

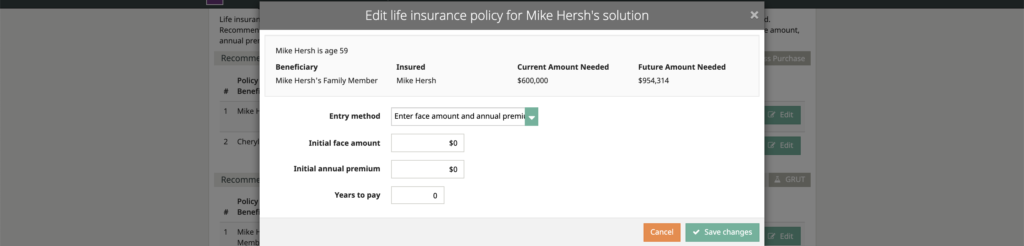

By selecting the edit life insurance button, the screen then shows you the owner, beneficiary of the policy and who the insured is. It shows what amount would be needed using the current business value and what amount would be needed if the future business value were used. Keep in mind, we don’t know exactly when death will occur, so we don’t know which of these values to use. These amounts are used as a guide. Often, the policies might even be rounded, figuring that corporate cash would be used to make up the difference or the individuals would use their personal cash to make up the difference.

Enter the initial face amount of the policy, the annual premium and the number of years to pay the premium. The value whenever death occurs will be used and illustrated in the ledgers. This is the quickest and simplest way to enter a policy values.

Enter schedule of annual values

Manually enter the schedule of annual values for Premium, Net Death Benefit, Net Cash Value, Loan, and Withdrawal. Simply run the illustration for the desired vendor and, with the ledger, then transpose those numbers into the schedule. Since most software illustrations look at the calendar year, we prompt for the end of year and age they’d be at the end of each calendar year. You need to coordinate and make sure you’re putting the right values for the right years into the schedule. Simply run the illustration for the desired vendor and, with the ledger, then transpose those numbers into the schedule.

Enter the premium in the first column. Tabbing will take you down the column to the next year. If the premium is the same for a number of years, use the “Copy down” button to duplicate the value down to the end of the schedule. If the premium changes or stops after say twenty years, simply scroll down to the 21st year, enter zero, and then copy down.

New death benefit

In case loans or withdrawals are used, you have dividends accumulating or buy paid up editions, this is the net death benefit for each year and again you enter that amount. If the amount is the same for a number of years, you can simply hit copy down and it will take it all the way to the bottom. You then scroll down to the next year that it changes or tab down if it’s one year at a time and enter the value from that point forward so that you can quickly enter all the values.

Then you come over to the net cash value and again recommend that you put in the net cash value. This is the net of any loan repayments, net of any withdrawals made. This is the net value at the end of each calendar year. Then go down and put any loans paid in a particular year or any partial withdrawals made in a particular year. The reason that you do both loans and withdrawals, sometimes the loan obviously you’re going to have the loan interest to be paid and the loan balance coming off the net death benefit so the loan requires interest but, at the same token, the loan is received income tax free

Withdrawals

Withdrawals are basically, up to the sum of the premiums, tax free. Subsequent to that, then any relative gains would be taxed. Match up your illustration with the ledger and enter the values for each corresponding year. The Copy down function can be used the same way as in other columns. After you finish the illustration and enter all the information into the schedule, you will need to “Save changes” before you proceed in order for your entries to be retained. If for any reason you want to clear the schedule and start over, click the “Clear schedule” button.