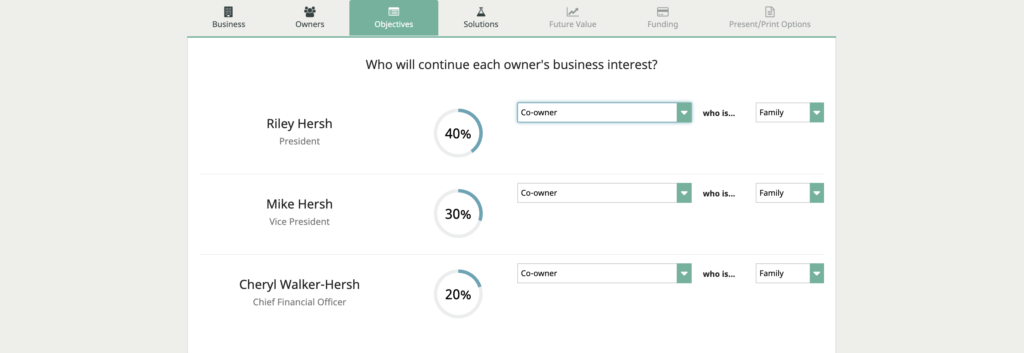

Objectives screen

The next screen deals with the objectives of each owner. Who does each owner want to continue their business interest? How do they want their business interest transferred? Who is going to buy their interest or how are they arranging that? We do that in couple of ways because depending on the relationship to the business owner, a co-owner or non-owner, and dependent whether it’s a family member or not, there are certain business continuation options available and not available.

For that purpose, we’re first saying who will continue this owner’s business interest? Is it a co-owner, non-owner or do they just plan to liquidate their interest for the best market value? In other words, just sell it piece-meal. They really don’t care who buys it or whether it is bought as a business – it’s bought as assets. Then what’s the relationship of the co-owner or non-owner? Is it a family or non-family?

The relationship determines certain rules that apply to selling to a family member as opposed to a non-family member or whether they’re in the business, not in the business. There is an easy chart available which basically shows what business solutions are available in all of these various combinations. Each owner does not have to have the same objective. For example, the owner or president might have desires to sell his or her shares to a son or daughter that’s active in the business.

Whereas, the next largest shareholder wants him to sell to the other owners but they are not related to any of them. There’s a different possibility. Each owner does not have to have the same objective. That’s one advantage of the Business Continuation Program–it can handle multiple objectives to deal with all the unique personalities and objectives of each business owner.

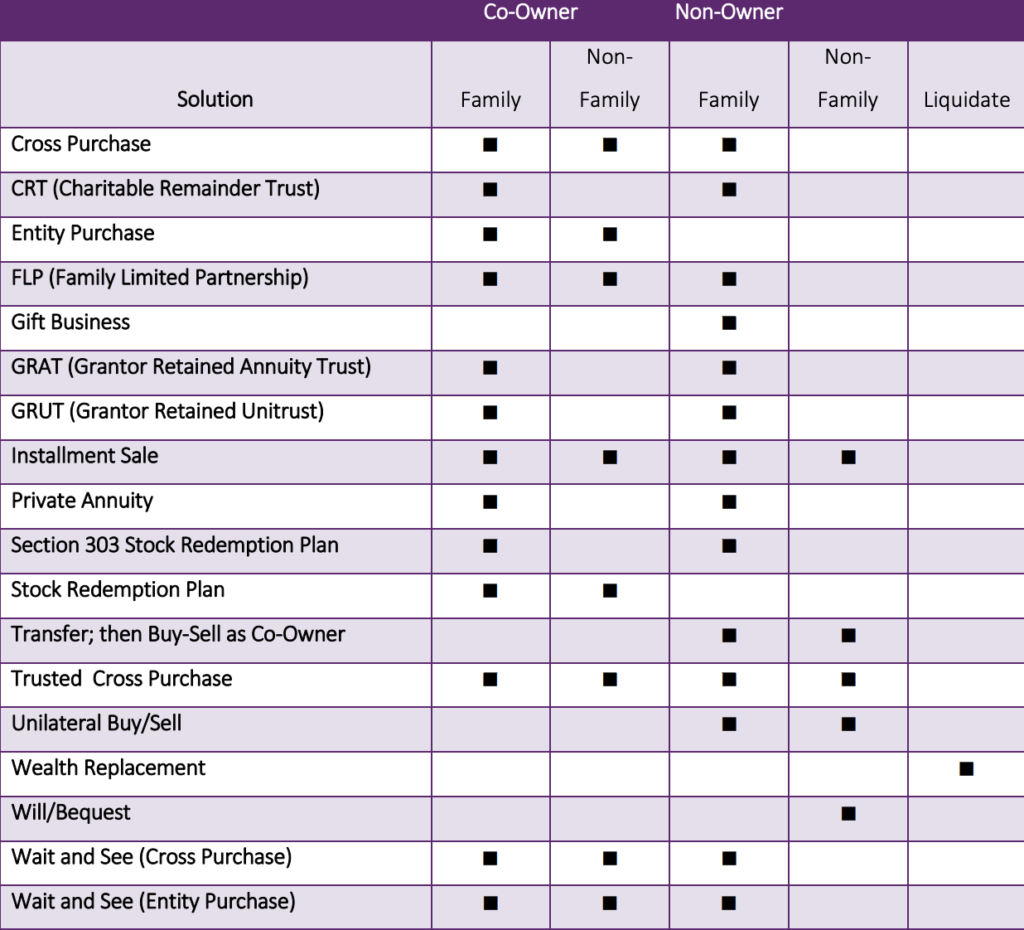

Chart

This chart will help clarify what is considered family and non-family.

Warning notes

One important thing is the message comes up indicating when there’s already been insurance policies associated with a solution and an owner. Obviously that they have been tailored for a unique situation if the objective changes to where that’s not applicable. It’s simply a warning that if you change the objectives that the insurance that’s been associated with that or the other would be lost and you’ll have to re-enter it because it won’t be applicable. Just a warning so that you don’t undo something just to look at something. This is when you’re reviewing a plan so that you don’t inadvertently change things on one screen that you entered on a later screen.