Business basics

This is general information relative to the various input screens in Business Continuation.

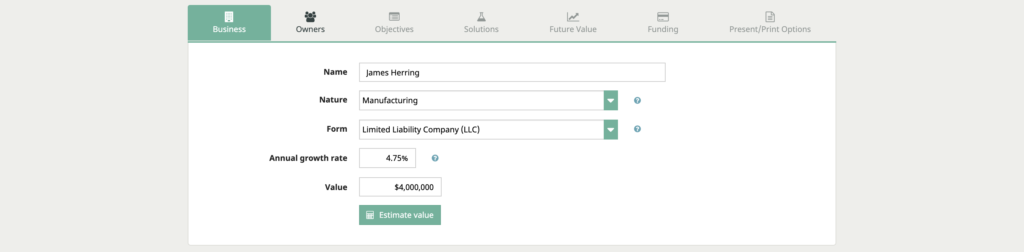

The name of the business should be entered exactly as it should be printed on the presentation.

The nature of the business. There are general categories in the nature of the business to compare various industrial and commercial types of business. These match the SIC Codes, which are found in the Standard Industrial Classification manual. This is very helpful and needed for various types of business insurance quotes, such as group life and medical, property and casualty, workers comp and other business related policies

Form of business refers to how the business is organized for income tax purposes. The various pass-through organizations as well as the typical tax corporations. C corporations being the most common and S corporations being the next most common amongst small employers.

The corporate tax bracket

Generally speaking, the corporate tax bracket would be illustrated at 35% but any amount can be entered. For some tax forms, this field may be hidden since they do not have tax or have a standard tax rate.

The annual growth rate

The annual growth rate represents the average annual earnings of the business as a percentage of the revenues. It’s used to reflect the growth rate for the immediate future.

Value of the business

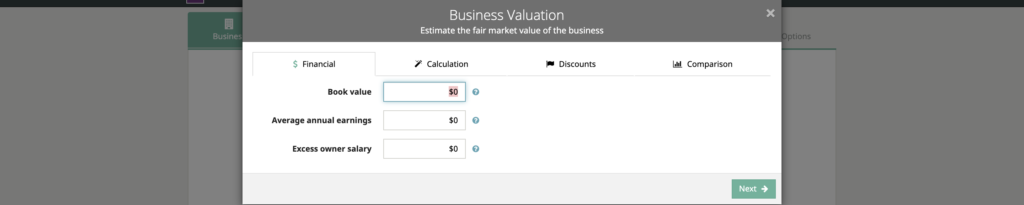

The value of the business can be entered several different ways. If the employer gives you a value, you can just enter directly. The value that the business owner prefers to use. By clicking the estimate value button, the business continuation will help determine several different standard methods for valuing a business as guide to assist in determining which value to use. The value of the business is really broken into four units to estimate first the financials which start with the book value

Please note

Click the down arrow to the right of the Estimate value prompt to access the print command. Clicking the print command enables you to print any of the seven pages dealing with the Business Valuation without printing the complete Business Continuation report. These are the same pages as in the Business Continuation report except this enables you to print the evaluation separate from the Business Continuation. Makes for a nice seven-page summary of the values.

This is especially useful when presenting Business Continuation to a group in which you might want to print just the Business Valuation for everyone and then for each owner print their own personal copy of the Business Continuation that applies to them.