Survivor needs goal

Survivor Needs Goal accounts for financial planning relative to the effects of lost income due to death of a spouse. Whether the client in question has children or dependents under the age of eighteen will dictate the suggested percent of current income to replace. Those who have dependents may require a higher income need. The age of the client you are planning for will help decide the time frame needed to provide supplementary income based on an established amount of time or until the death of the widowed spouse.

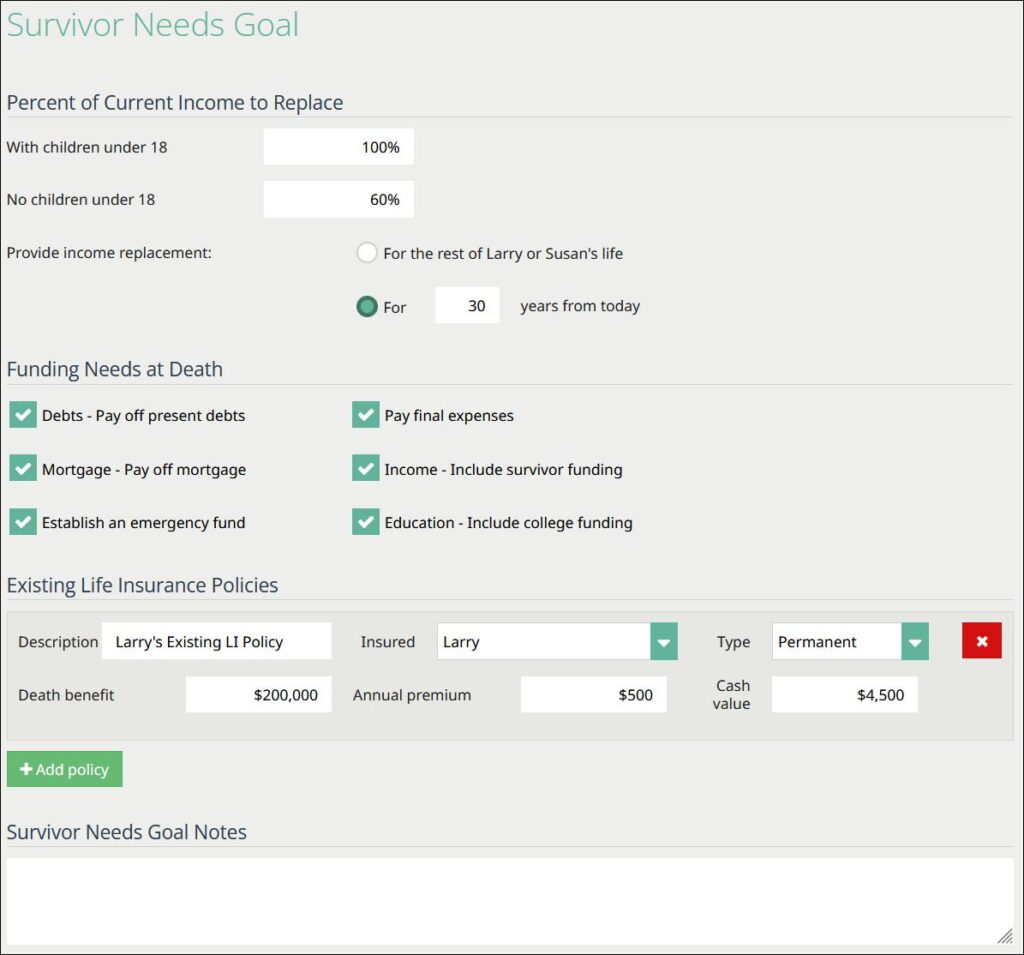

Percent of Current Income to Replace

If there are dependents under the age of 18, you will see two prompts, one for “With children under 18” and one for “No children under age 18”. Input a percent of current income you want replaced if death were to occur. If there are no dependents, or no dependents under the age of 18 you will only see the prompt for “No children under 18”.

The other input needed in this section is how long income replacement is to occur. The two options are for the rest of client or spouse’s life, or a specified number of years.

Funding Needs at Death

Life Goals understands that every client has a different financial plan and allows you to forecast future savings based off the need for the following.

- Paying off present debt

- Paying off a current mortgage

- Covering the cost of funerals and final expenses

- Education

- Income for survivor funding

- Establishing an emergency fund

Existing Life Insurance Policies

If your client or spouse currently has existing life insurance, there is a section at the bottom to add such, just click “Add Policy”. Multiple policies can be entered.

Survivor Needs Goal Notes

Any notes added to the “Survivor Needs Goal Notes” section will show on the Advisor Notes page in the printed output.