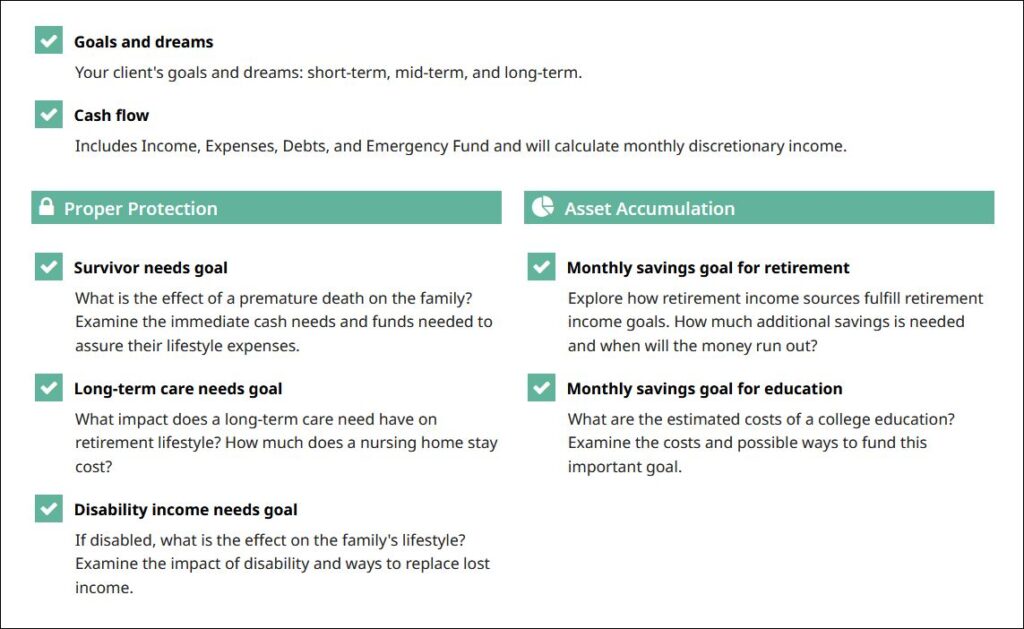

Choose Modules

The first tab in creating a Life Goals case is titled “Choose Modules”, here you can choose from a handful of goals and objectives that your clients wish to meet.

The first module to choose from is “Goals and dreams” which maps your clients short-term, mid-term, and long-term goals. These include planning for large purchases, buying a new home, building retirement wealth, and paying off debt.

The Cash Flow module allows your clients to assess their income, expenses, debts, and emergency funds which will help to calculate their monthly discretionary income and adjust savings and investment goals accordingly.

Proper Protection

The Proper Protection modules account for the unexpected. Selections include planning for survivor needs goals, long-term care needs goals, and disability income needs goals. Life Goals will log and make recommendations for supplementary income that will support unexpected spousal death, nursing home costs, and protected income in the event of career ending disability.

Asset Accumulation

The Asset Accumulation modules provide tools to explore how retirement income sources fulfill retirement income goals and how much additional savings are needed while accounting for when money will run out. Asset Accumulation also accounts for the estimated costs of a college education using an up to date database that covers costs of annual expenses for every college in the nation.