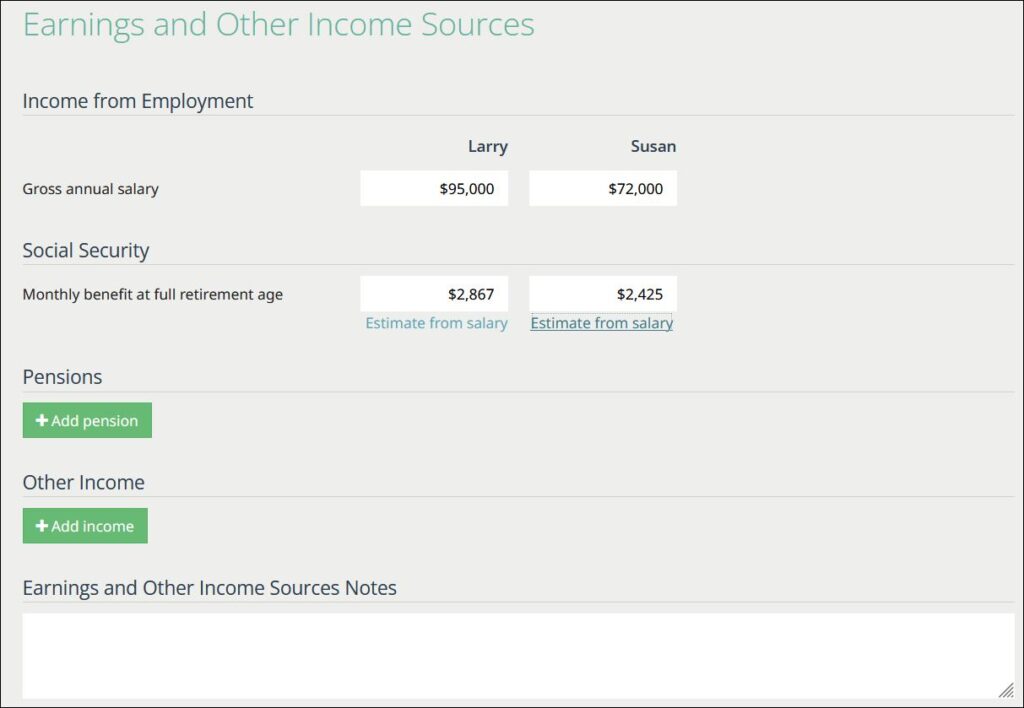

Earnings and Other Income Sources

This section is the basis for the Life Goals planning tools. From here we are able to assess the amount of money your client will have from both active and passive income. Income from employment is accounted for along with projected social security earnings upon retirement. If your client does not know how much Social Security they are projected to receive, simply click “Estimate from salary”. This will give you an estimated benefit based on the current year tables. Any notes added to the “Earnings and Other Income Sources Notes” section will show on the Advisor Notes page in the printed output.

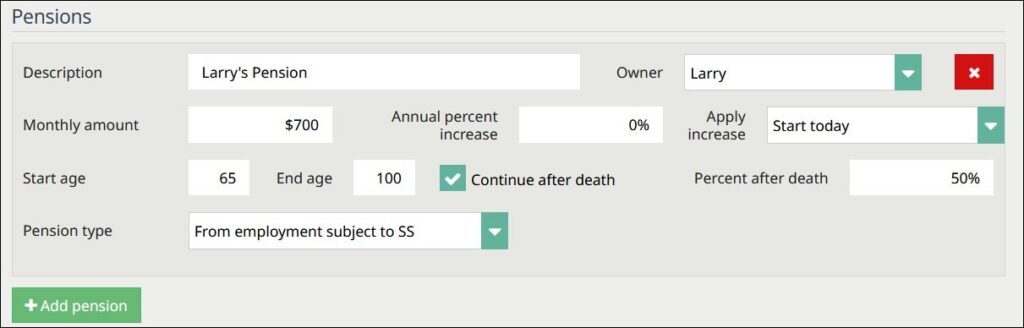

Pensions

If your client has a pension, click “Add Pension” and fill out the information required. The drop down Pension type allows you to select whether or not the pension is from employment that is subject to social security. To continue Pensions after client death, check “Continue after death” and specify a percent after death.

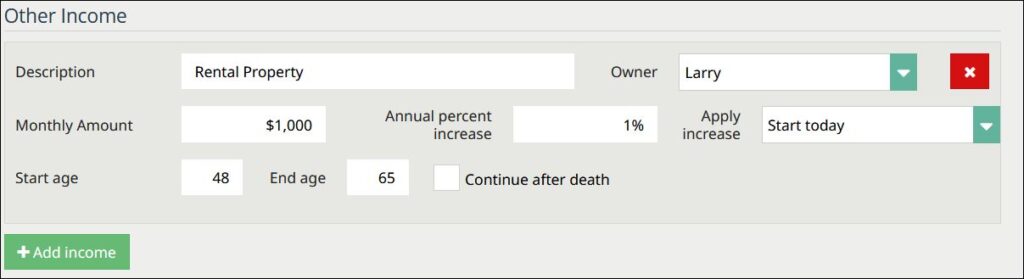

Other Income

This section is for input of Other Income that is not employment or Pension related. An example might be income from Rental Property.