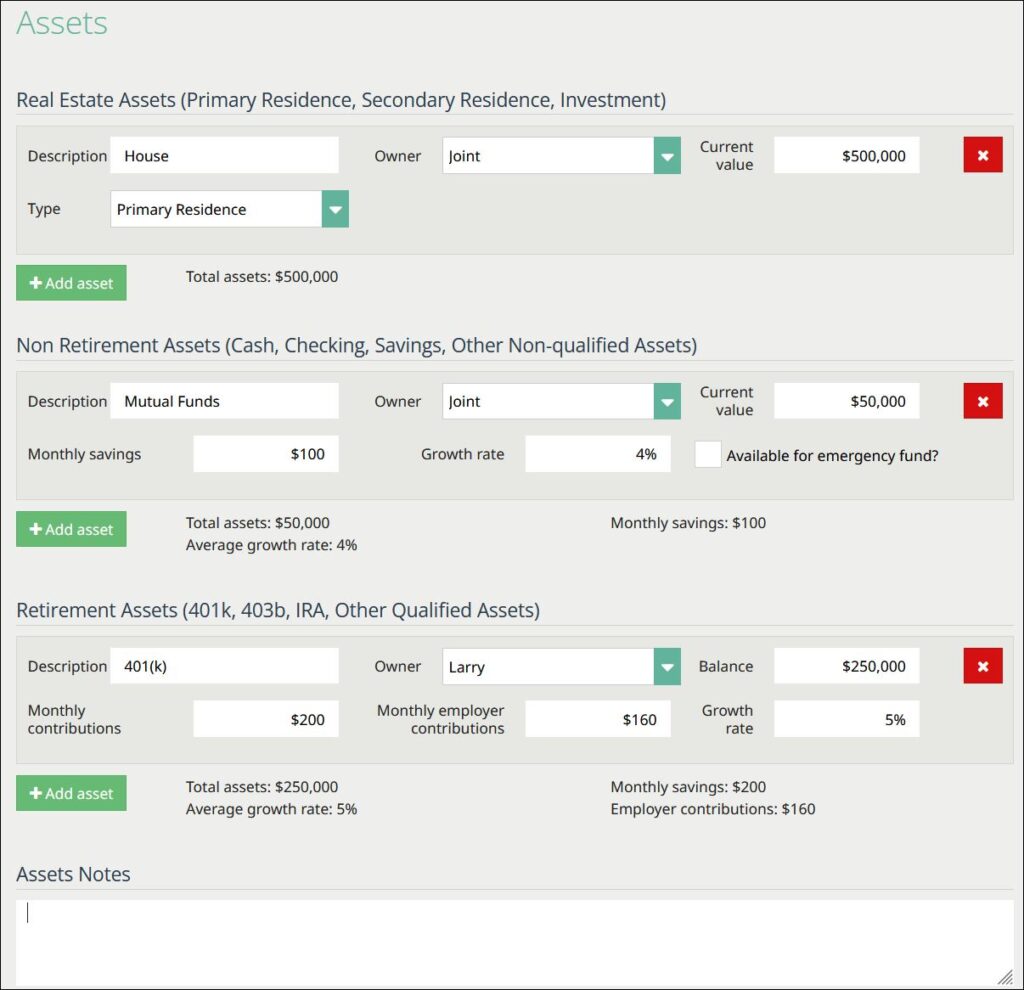

Adding assets

Life Goals allows you to add assets based on three categories.

- Real Estate Assets (Primary Residence, Secondary Residence, Investment Income)

- Non-Retirement Assets (Cash, Checking, Savings, Other Non-Qualified Assets)

- Retirement Assets (401k, 403b, IRA, Other Qualified Assets)

Non Retirement Assets

We account Non Retirement assets based on current value, monthly saving, and growth rate. If any of the following assets are available for an emergency fund, check the “Available for Emergency Fund” box and Life Goals will account for this in the “Summary Analysis” section at the end.

Retirement Assets

When documenting Retirement Assets, Life Goals asks for current balance, monthly contributions, monthly employer contributions, and growth rate.

Assets Notes

Any notes added to the “Assets Notes” section will show on the Advisor Notes page in the printed output.