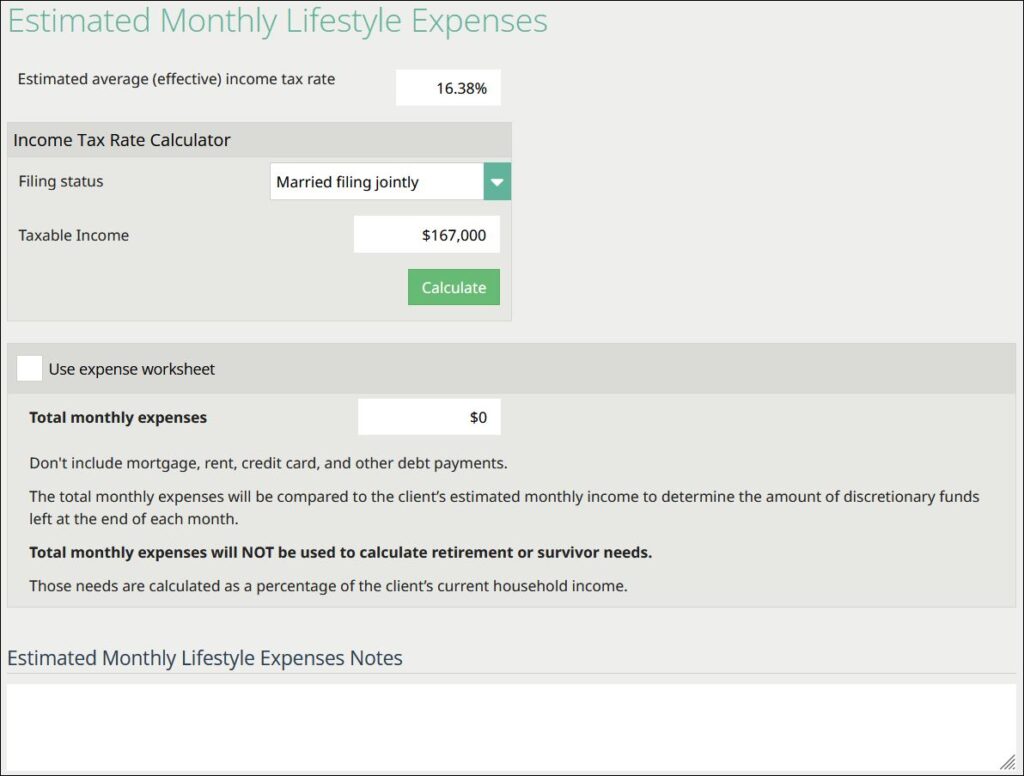

Estimated monthly lifestyle expenses

Income Tax Rate Calculator

You can input an estimated average (effective) income tax rate or you can use the Income Tax Rate Calculator. This tool calculates your Estimated average (effective) income tax rate for you based on Filing Status and Taxable Income using the latest tax tables. Keep in mind this is subject to change based on earnings and state tax laws.

Click the drop-down arrow to choose how they will be filing…

- Married filing jointly

- Married filing separately

- Head of household

- Single

Be sure to account for taxable income during this section.

Monthly Expenses

Here you can input your Total monthly expenses or you can utilize the “Expense Worksheet” that provides rows of common monthly expenses ranging from food and internet to tithe and charity. At the bottom, there is room for miscellaneous expenses not in the list.

Estimated Monthly Lifestyle Expenses Notes

Any notes added to the “Estimated Monthly Lifestyle Expenses Notes” section will show on the Advisor Notes page in the printed output.