Additional information

Qualified Plan Concepts allows you to enter non-qualified assets to your clients Wealth Transfer plan. Enter the total amount of the asset along with a growth rate under 12%, you must also enter the income tax rate and how long it is effective for.

Desired distributions

Under the “Desired Distributions” tab for the “Qualified Wealth Transfer” objective you may enter how your client wishes to use distributions to pay life insurance premiums.

If you choose to utilize the “Load illustration from Link File” when inputting the Entry Method, click “Import File” and choose from a pre-existing file on your desktop. If you are using any other method you must input the data manually.

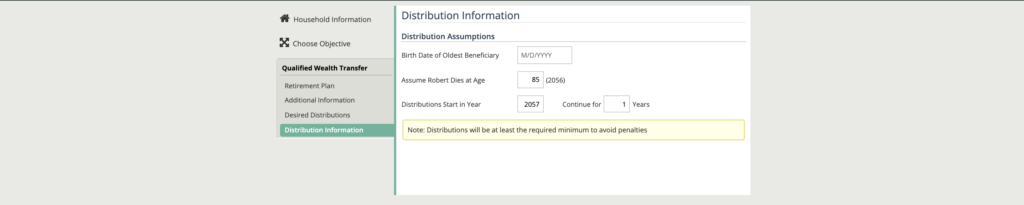

Distribution assumptions

The distributions assumptions section required you to enter the birth date of the oldest beneficiary on your client has listed on their plan. Assume the death of your client based off their current health, projected life expectancy, any other relevant information and enter the projected age next to “Assume ___ Dies at Age.” From here you can enter the year you wish distributions to start and how long they will continue for.

Note : Distributions will be at least the required minimum to avoid penalties.