Choosing objectives

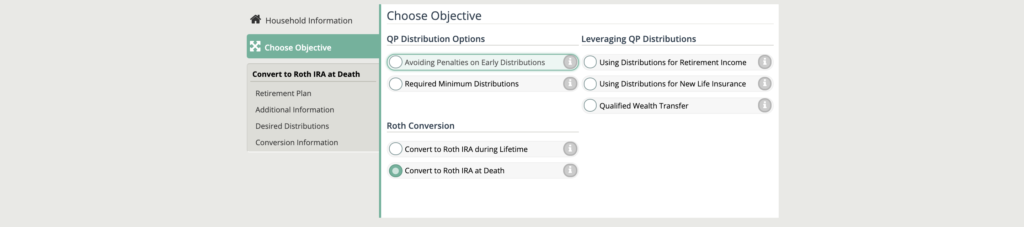

Qualified Plan Concepts offers three categories of objectives to build your case from. We allow advisors to choose planning tools relative to distribution options, leveraging distributions for retirement or life insurance, and converting to Roth IRAs at death or during lifetime.

Each objective is a “stand-alone presentation.” Providing a motivating presentation to leave behind and keep clients’ attention with compelling graphics and colors. QPC allows clients to illustrate the following.

- How to take qualified plan distributions

- How to effectively use qualified plan distributions

- How convert to a Roth IRA during life or at death

- Multi-generational planning – stretching your IRA and taxes over many years

QP Distribution Options

The goal of the Avoiding Penalties on Early Distributions objective is to illustrate early pre-59 ½ distribution options.

The target clients for this objective include

- Middle Market – Under $2MM Household

- Estate Tax Service – $2MM+ Household

- Family Years (30’s, 40’s)

- Near Retirement (50’s, 60’s)

Details

- Calculate pre-59 ½ distributions with no penalties using 72(t) Safe Harbor methods.

The goal of the Required Minimum Distributions objective is to illustrate required minimum distributions (RMD)

The target clients for this objective include

- Middle Market – Under $2MM Household

- Estate Tax Service – $2MM+ Household

- Retirement Years (60’s, 70’s)

Details

- Illustrate required minimum distributions at age 72.

- Utilize a QLAC with investments from your IRA

Leveraging QP Distriubtions

The goal of the Using Distributions for Retirement Income is to illustrate plans for retirement living expenses. The presentation for this objective shows values during retirement and at death.

The target clients for this objective include

- Middle Market – Under $2MM Household

- Estate Tax Service – $2MM+ Household

- Near Retirement (50’s, 60’s)

- Retirement Years (60’s, 70’s)

Details

- Project plan values with contributions and growth

- Pay living expenses with distributions

The goal of the Using Distributions for New Life Insurance objective is to illustrate the benefit of using qualified plans as a source of premiums for life insurance and to compare values during retirement and at death with and without proposed new life insurance.

The target clients for this objective include

- Middle Market – Under $2MM Household

- Estate Tax Service – $2MM+ Household

- Near Retirement (50’s, 60’s)

- Retirement Years (60’s, 70’s)

Details

- Calculate plan values during lifetime and at death

- Calculate plan values with and without new life insurance

- Compare Amount to Heirs with and without life insurance

- Compare paying living expenses, gifts and new life insurance premiums from QP distributions vs. other assets.

The goal of the Qualified Wealth Transfer is to illustrate the benefit of using qualified plan distributions as a source of premiums for life insurance. Compare values during retirement and at death with and without proposed new life insurance.

The target clients for this objective includes

- Middle Market – Under $2MM Household

- Estate Tax Service – $2MM+ Household

- Near Retirement (50’s, 60’s)

- Retirement Years (60’s, 70’s)

Details

- Calculate plan values during lifetime and at death

- Calculate plan values with and without new life insurance

- Compare Amount to Heirs with and without life insurance

Roth Conversion

The goal of the Convert to Roth IRA during Lifetime is to answer two main questions for clients, should I convert to a Roth and should I pay the taxes out of my IRA or out of Other Assets?

The target clients for this objective includes

- Middle Market – Under $2MM Household

- Estate Tax Service – $2MM+ Household

- Near Retirement (50’s, 60’s)

- Retirement Years (60’s, 70’s)

Details

- Compare converting vs. not converting in three simple graphs

- Illustrate the conversion immediately (next month) or any future year before death

- Choose to pay conversion taxes out of IRA or Other Assets

The goal of the Convert to Roth IRA at Death is to show a client the benefits of the Roth conversion and highlight a great way to pay taxes – life insurance! You can also illustrate a spouse converting to a Roth at death of the IRA owner and use life insurance on the IRA owner to pay conversion taxes.

The target client for this objective includes

- Middle Market – Under $2MM Household

- Estate Tax Service – $2MM+ Household

- Near Retirement (50’s, 60’s)

- Retirement Years (60’s, 70’s)

Details

- Compare not converting vs. converting with new life insurance

- Illustrate the conversion at the death of the IRA owner

- Compare future Net Worth of surviving spouse with and without the new life insurance

- Illustrate paying life insurance premiums from the IRA