Avoiding Penalties

This objective utilizes the Internal Revenues tax code 72(t) which allows penalty-free withdrawals from IRA accounts and other tax-advantaged retirement accounts like 401(k) and 403(b) plans.

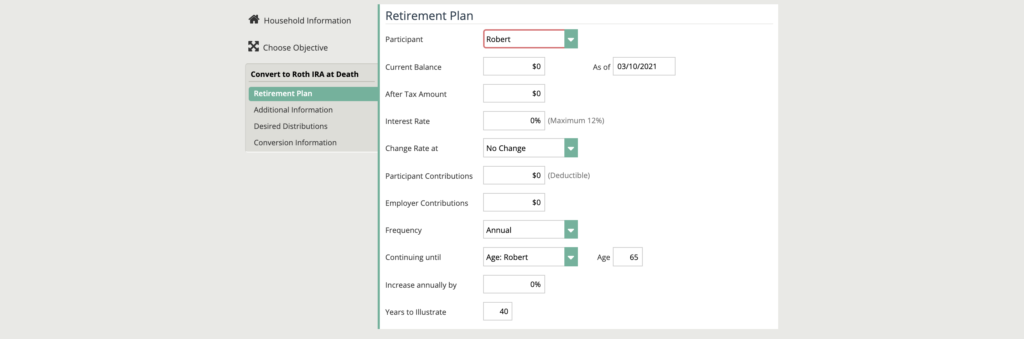

By calculating the inputs from the “Retirement Plan” tab, Qualified Plan Concepts is able to aggregate 72(t) distribution assumptions based on a multitude of different factors.

The first drop down arrow option determines when the participant (client A or B) wishes to start taking retirement distributions, you can choose from starting today, going by the calendar year, or by a predetermined age from one of the clients or their spouse.

Distribution Assumptions

Single vs. Uniform Lifetime Table

The uniform distribution table is the life expectancy table to be used by all IRA owners to calculate lifetime distributions unless your beneficiary is your spouse who is more than 10 years younger than you.

The single life expectancy table is based on the age after the IRA owner’s death. That factor is reduced by one for each succeeding distribution year.

Many people are opposed to paying the penalty tax for early distributions and ask the question, “Is there a way to avoid it?” Yes, there is: Safe Harbor distribution methods. Following the rules of the Safe Harbor distribution methods is one of the exceptions for the 10% early distribution penalty. There are three methods that qualify as a Safe Harbor method:

- Life expectancy method is calculated the same way as Required Minimum Distributions (RMD), but it simply starts at a younger age. It’s a variable annual payment that fluctuates with the account balance each year. It is usually the smallest initial annual payment and the annual payment may increase or decrease if the account earns more (or less) interest than assumed in the projected calculations.

- Amortization Method is a level annual payment amortized over life expectancy that, once calculated, the distribution remains the same each year. It is usually a lower annual payment and slower spend-down of the account, and there are more choices for life expectancy calculation.

- Annuity Method is very similar to the amortization method, but it uses a level annual payment based on the life only annuity tables. It is usually the highest annual payment and fastest spend-down of the account. It is the least flexible method.