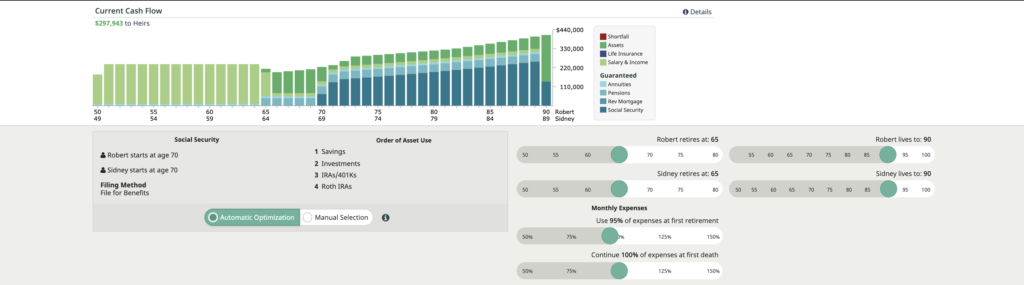

Current cash flow

The Current Cashflow tab illustrates the summation of your client’s financial portfolio and puts it into readable and understandable data that forecasts cash flow for years to come. Based on the financial standing of the client at hand, you will either see a dollar amount left to heirs of the family or a dollar amount followed by “shortfall.”

Cash Flow Decisions offers insights and recommendations on the right side of the screen that are useful for minimizing shortfall or maximizing money to heirs. The sliders on the bottom of half of the screen can be used to sample different scenarios such as age of retirement, increase or decrease in monthly expenses, and age of death. Upon adjusting the sliders, the illustration will update in real time to play out different scenarios.

The “Order of Assets Used” shows which of your client’s assets will be liquidated or utilized first in order to provide financial coverage after retirement.

In the top right corner there is a feature titled “Details” that launches a tab filled with additional graphs, ledgers, and insights into income, taxation, cash flow, and social security.

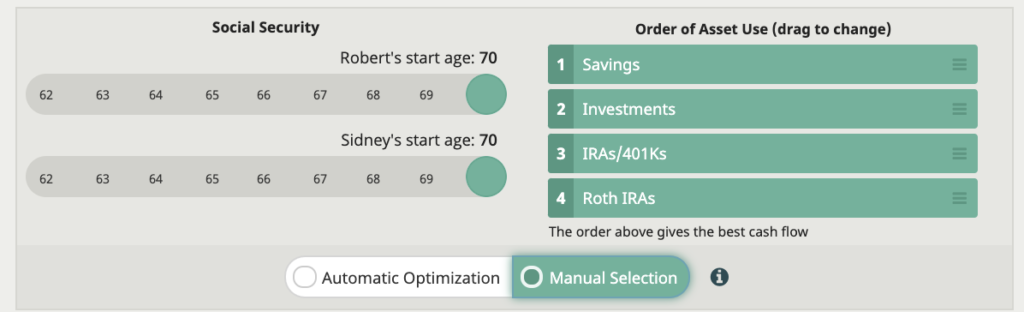

Automatic vs Manual Selection

When mapping out your client’s proposed and current cash flow you are given the option to allow Cash Flow Decisions to aggregate the data entered and provide you with suggestions based on how our software plans to maximize portfolio efficiency by using the “Automatic” function.

Based on client preferences and your own personal recommendations you can rearrange the way assets are utilized by choosing the “Manual” function. The manual function enables advisors to change the order of assets used and also use sliders to show different outcomes based on retirement age.