Retirement assets

The first step in entering your client’s assets into the Cash Flow Decisions tool is covering the bases on retirement assets. You can enter your client’s IRAs and Roth IRAs along with 401k and 403b by clicking on the appropriate tab on the left-hand side of the screen. Retirement assets such as the ones listed above are the most common form as asset the average American owns and will help to calculate cash flow in the end of this process.

Other assets

Assets such as personal savings or investments are also to be included in your client’s Cash Flow Decisions planning. The growth rates of both a savings account and any investments your client currently holds are used to help project their flow of income and liquidity options in the future.

Life insurance and annuities

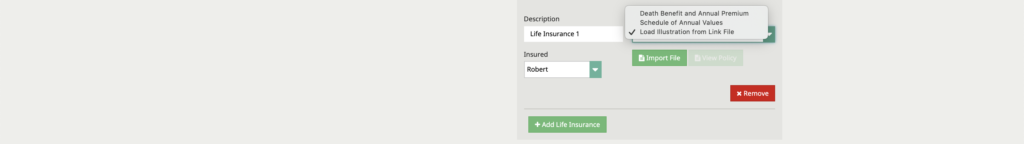

If your client has a pre-existing life insurance policy, there are a variety of ways to enter that into our system. The “Death Benefit and Annual Premium” option allows you to enter the face amount and annual premium on the policy, while the “Schedule of Annual Values” method provides a chart that includes the premiums, death benefits, cash value, loan, and withdrawal values for each year.

If pre-existing file has already been prepared containing any of this information, utilize the “Load Illustration from Link File” option and simply drag and drop the document after clicking “import File”

When adding an annuity to your planning process, click “+Add Annuity” and choose the annuity type. Fixed Income, Withdrawals, and Guaranteed Withdrawals are all options for the annuity type and require the values of your clients, ideal start age, current income, and current balance.