Market downturn

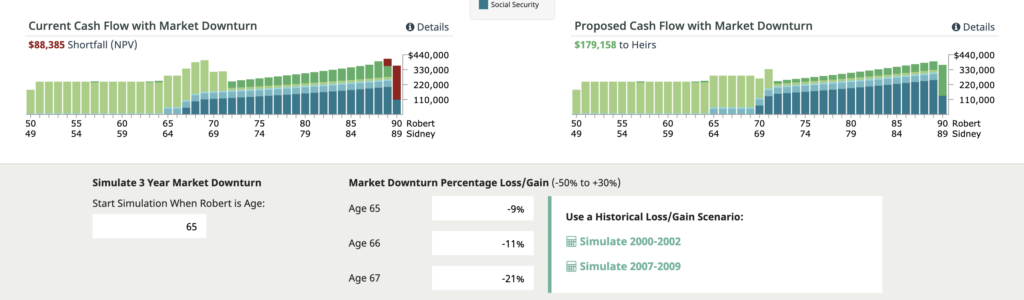

The Cash Flow Decisions software allows advisors to compare current cash flow to proposed cash flow in the event of a market downturn. By simulating possible downturns in the market, we are better able to understand and predict how your client’s financial future may look.

Stress testing is important when planning for the future, so we featured two additional simulations that show mimic the 2000-2002 and 2007-2009 market downturns. You may also input projected losses or gains based on suggested age for each client.