Salary

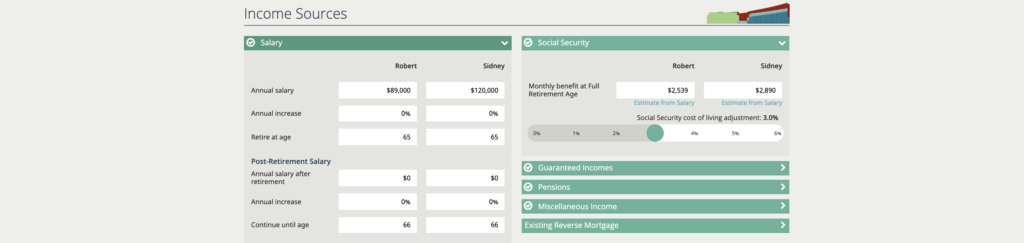

A majority of Americans receive the bulk of their income from a fixed salary. Under the “Salary” tab you can enter in all of the information regarding your client’s annual salary which includes projected increases and retirement age. Underneath that is a section for any post-retirement salary that your client may continue to receive upon leaving the workforce.

The “Social Security” tab enables you to enter the monthly benefit your client will receive at full retirement age. If this amount has not been determined yet we recommend using the Social Security Pro tool that is already in your Advisor Control bundle, it is quick and easy and provides an accurate number as to what your client will earn in social security based off their contributions and projected retirement age.

Additional Income

Click on the arrow to the right of the type of the category of income your client may have and input the information boxes in accordingly.

Guaranteed Income is any income your client knows they will continue to receive for a certain duration of time and may include structed settlements, inheritance, or disability payments.

Pensions fall under Additional Income Sources and can be added under the “Pensions” tab. The monthly amount, annual increase (if applicable), and start and continue till age are all taken into account here.

Miscellaneous Income can be entered following the same parameters as the rest of the types of income and can also be marked “Tax Exempt.” Enter any type of current or future income here that does not fall under the other categories, this may include rental property income, side hustles, prizes and awards, or anything else that falls outside of typical employment payments.

Utilizing an existing reverse mortgage to pay off an existing one can also be classified as a source of income and monthly income and start age should be input into the designated box.